Is It Smart to Buy Stocks With the S&P 500 at an All-Time High? History Has a Clear Answer

Trying to determine the best time to invest your hard-earned money can be a daunting task.

When the stock market hits a new high, it seems like there’s nowhere to go but down. After all, every bear market begins, by definition, just after the S&P 500 hits a new all-time high. But when stocks fall, it can be equally scary. There’s no telling how much further stock prices will drop.

After a sharp pullback in the S&P 500 in early August, the index has roared back toward its all-time highs. You might be kicking yourself for not buying on the dip. But even if you missed out on that short-lived opportunity, history suggests it’s still a great time to invest right now, even as the market pushes to new all-time highs.

Stocks usually keep going up after hitting an all-time high

Every investor knows stocks increase in value over the long run. Why else would you invest if you didn’t expect your investment to increase in price?

So, even when stocks are trading at an all-time high, the expectation from investors is stocks will eventually reach even higher highs. The question is how quickly will stocks reach that new higher high? Some investors may worry that it may take a long time for those new highs to come because every investor also knows the stock market doesn’t go up in a straight line.

But new all-time highs tend to cluster together. Once the market reaches a new high, it often keeps going up for some time. In 1995, for example, the S&P 500 closed at a record high 77 times, which comes out to approximately 30% of all trading days in that year. The S&P 500 has closed at a new all-time high 38 times so far in 2024 since setting a new high on Jan. 19.

While the S&P 500 has already moved more than 16% higher since hitting its first new all-time high in over a year in January, the long-term returns could be even greater. The average bull market lasts 46 months with a median total return of 110%. We’re only 22 months out from the lows of October 2022 and up 62%. If it holds to the average, this bull market could have another 2 years to go, rising an additional 30% from here.

In fact, investing when the S&P 500 hits a new all-time high has historically led to stronger results than investing on days when it doesn’t hit a new all-time high. Since 1970, in the 12 months following a new all-time high, the S&P 500 has produced an average return of 9.4%. In the following 24 months, it returned 20.2% on average. That includes investing at the very peak of the market before a new bear market. By comparison, investing at any other time resulted in average returns of 9% and 18.5% for 12-month and 24-month periods, respectively.

All this is to say, now is a great time to invest in the stock market.

How to invest when the stock market is trading at an all-time high

It can be difficult to find good individual stock investments as the overall market climbs higher. There simply aren’t as many companies whose stocks are trading at an attractive value compared to the middle of a bear market. Still, there are plenty of great opportunities for dedicated investors to find if they put in the work.

However, digging into financial reports and studying the inner workings of various industries and the economic factors that could influence them isn’t for everyone. One of the most effective ways to invest, particularly at an all-time high, doesn’t require deep knowledge and understanding of multiple companies. You can buy a simple index fund that tracks a broad index like the S&P 500.

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is one of the best available. Its low expense ratio and strong record of tightly tracking the index ensure you’ll earn returns very close to the S&P 500. And, as history shows, those returns can be quite strong, especially after setting a new all-time high.

There are dozens of ways to invest your money when stocks trade near an all-time high. It rarely pays to sit on cash and hope for a pullback in prices before investing. More often than not, stocks will continue to push higher. That said, when there is a pullback like we saw in early August, it usually works out well if you can seize the opportunity with any excess cash you have to invest. There’s no telling how long the opportunity will last, but it’s virtually guaranteed that the stock market will keep setting new all-time highs over the long run.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Is It Smart to Buy Stocks With the S&P 500 at an All-Time High? History Has a Clear Answer was originally published by The Motley Fool

Intel Stock Is Soaring. Can a Breakup Plan Save the Company?

Shares of Intel (NASDAQ: INTC) were on the move Friday in the wake of news reports that the company was considering the possibility of spinning off its manufacturing arm from its core chip design operation in order to rehabilitate itself and create value for shareholders.

That news came after a disastrous earnings report earlier this month that included weak results, disappointing guidance, the elimination of the stock’s dividend, and a restructuring plan that will cut at least 15% of its workforce.

Investors, who have been eager for any signs of change at Intel, cheered the news, sending the stock up by 7.6% as of 1:10 p.m. ET.

Is it time to break up Intel?

According to Bloomberg, Intel is discussing strategic options with investment bankers — options that could include splitting its two primary business segments or ditching some of the planned factory expansions that have been the cornerstone of CEO Pat Gelsinger’s transformation strategy.

Intel’s board is expected to review a range of options in September.

It shouldn’t come as a big surprise that Intel is considering such major changes, as it’s clearly flailing, and the stock is hovering around 20-year lows.

Is Intel stock a buy on the news?

At this point, Friday’s gains look more like a dead cat bounce for the stock than anything fundamentally meaningful. Cleaving the manufacturing business from the rest of the company could be a win for investors as the foundry operations have been a drag on its overall results, but doing so would also undermine Gelsinger’s long-term strategy. Such a change might even call for a new CEO.

While the issue is worth watching, and investors should pay attention to any news coming out of next month’s board meeting, Friday’s jump seems like more of a sign of desperation from investors than a real reason to buy the stock.

Expect the volatility in Intel shares to continue as its restructuring still has a long way to go.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $720,542!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Intel Stock Is Soaring. Can a Breakup Plan Save the Company? was originally published by The Motley Fool

Housing Market In 'Biggest Bubble Of All Time,' Warns Reventure CEO: 'This Situation Is Not Sustainable'

The U.S. housing market is under renewed scrutiny, as some experts warn of an unsustainable bubble that could rival or surpass the infamous crash of 2006.

Nick Gerli, CEO of Reventure Consulting, sounded the alarm on X, formerly Twitter, pointing to inflation-adjusted home prices that have soared to nearly double their 130-year average. “We are in the biggest housing bubble of all time,” Gerli said in a tweet thread, highlighting a disconnect between home values and historical norms.

Don’t Miss:

Gerli’s analysis paints a troubling picture. Only twice in U.S. history have housing prices reached such dizzying heights relative to long-term averages – in 2006 and now.

The implications, he argues, are clear. “This situation is not sustainable. Home prices must crash, or inflation needs to skyrocket out of control. Or perhaps some combination thereof.”

Trending:

Gerli’s assessment comes when the housing market appears at a crossroads. Recent data from the S&P CoreLogic Case-Shiller Home Price Index shows that while price increases are slowing, with a 5.9% annual gain in May compared to 6.4% in April, home values continue to set records.

Lisa Sturtevant, chief economist at Bright MLS, told Forbes that she sees the strain on buyers. “Affordability is the main constraint on the housing market,” she said, predicting a move toward a more balanced market later this year, with continued competition among prospective homeowners.

According to Gerli, the crux of the issue is the relationship between home prices and incomes. Current home prices stand at a multiple of 4.5 times income, a level seen only twice before – during the 2006 bubble and in the early 1950s. He points out that the resolution in the 1950s came through a decade of stagnant home prices coupled with robust income growth – a scenario he views as unlikely in today’s economic climate.

See Also:

Not all regions are equally affected, however. Gerli said states like Florida, Tennessee, and Texas are epicenters of the bubble. Those areas have seen home values dramatically decoupled from local incomes. On the other hand, states like New York and Illinois show more modest overvaluation, resulting in tighter inventory as more buyers can participate in those markets.

The path forward is uncertain. Keith Gumbinger, vice president at HSH.com, an online mortgage company, told Forbes that a housing recovery would require an increase in inventory and a gradual cooling of mortgage rates. “Better that rate reductions happen at a metered pace, incrementally improving buyer opportunities over a stretch of time, rather than all at once,” he said.

Trending:

Still, according to a Zillow analysis, the inventory shortage persists, with levels 33% below pre-pandemic averages.

Whether it represents a bubble on the brink of bursting or a new era in homeownership, the average American is still priced out of many housing markets.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Housing Market In ‘Biggest Bubble Of All Time,’ Warns Reventure CEO: ‘This Situation Is Not Sustainable’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

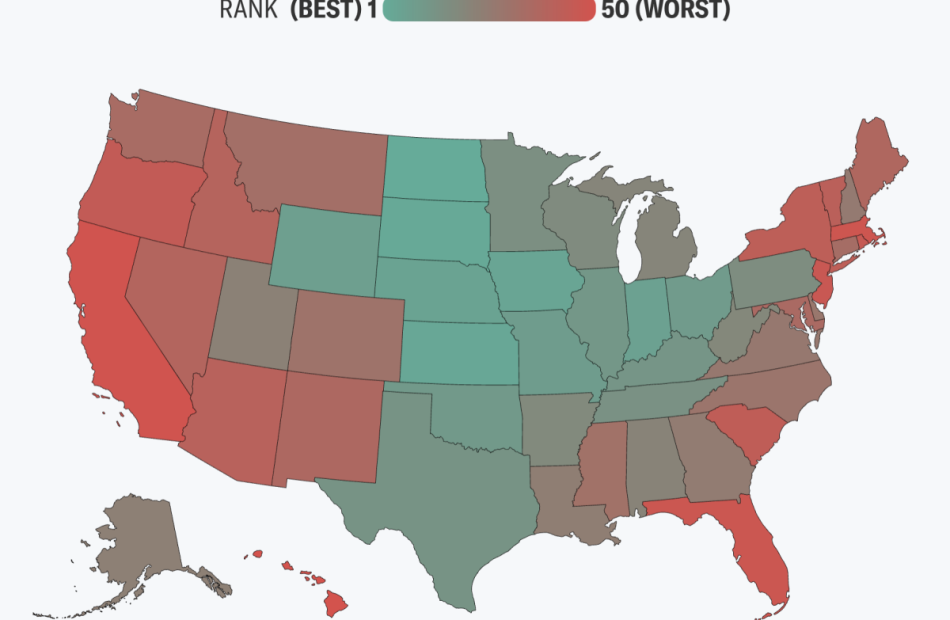

These are America’s best and worst states for saving money in 2024

Does saving money feel like a challenge, even if you earn a decent income or keep a tight budget? It may have something to do with where you live.

Factors such as how much you earn, the price of daily essentials, housing costs, taxes, and more can impact your ability to save, some of which may be out of your control — and depend on the state you live in.

Curious about how your state aids or impedes your ability to save? We evaluated seven key metrics across all 50 states to determine the best and worst states for savers. (See our full methodology here.)

5 best states for saving money

1. North Dakota

North Dakota scored the top spot on our list as the best state for saving money. This state has one of the lowest costs of living, combined with a strong median annual household income of $78,720.

The state also has a significantly lower top marginal state income tax rate than some of the other states on our list. Finally, less than 40% of North Dakota renters and less than 23% of homeowners are housing cost burdened (defined as spending 30% or more of household income on housing costs).

Read more: What percentage of your income should go to a mortgage?

2. South Dakota

South Dakota came in second place with a median household income of $67,180 and the lowest combined percentage of housing-cost-burdened renters and homeowners across the country.

South Dakota also has the ninth-lowest household debt-to-income ratio across all states. Another perk: South Dakota is one of nine states with no income tax, making it easier for residents to allocate more of their paychecks toward savings.

3. Kansas

Kansas took the third spot on our list, with a median household income of $73,040 and one of the lowest percentages of housing-cost-burdened homeowners across the country.

Kansas also has the third-lowest cost of living. Further, the sales tax rate in Kansas is 6.50%, which is a bit higher than some states on our list, but its top marginal income tax rate sits at 5.70%, which is about the median point across all states.

4. Iowa

Fourth on our list is Iowa, which has the lowest percentage of housing-cost-burdened homeowners in the nation, at 18.7%. The median annual household income in Iowa is a substantial $76,320. Residents also pay modest taxes, with the top marginal state income tax rate of 5.70% and a state sales tax of 6%.

5. Nebraska

Nebraska took the fifth spot on our list of the best states for saving money. The annual median household income is an impressive $78,360. Further, the sales tax rate in Nebraska sits at 5.50%, along with an effective property tax rate of 1.63%. Nebraska was also one of the states with a lower percentage of housing-cost-burdened renters and homeowners — 42% and 21.2%, respectively.

5 worst states for saving money

1. Hawaii

The worst state for saving money is Hawaii. This state has the second-highest individual income tax rate and the highest cost of living in the country. It also has the highest household DTI, despite the median household income being a whopping $91,010.

Renters and homeowners in Hawaii face higher housing costs as well, with over 56% of renters and 36% of homeowners burdened by housing costs.

2. California

It may come as no surprise that the state known for high taxes and cost of living is the second-worst state for saving money. With the highest top marginal income tax rate of all the states (13.30%), the highest sales tax rate (7.25%), and the second-highest score for cost of living, savers may not have much income left over to put in their savings accounts.

The median household income in California is $85,300, but even a higher salary isn’t enough to cover California’s housing costs in many cases. As it stands, 53% of renters and 37% of homeowners are burdened by housing costs.

3. Massachusetts

Massachusetts is the third-worst state for saving money, according to our data. It has the second-highest median household income out of all the states we compared at $93,550. Still, nearly half of all renters and close to 30% of homeowners in Massachusetts are burdened by housing costs. Massachusetts also had the third-highest cost of living across all states.

4. Florida

Florida came in fourth place among the worst states for saving money. The median household income in Florida is $65,370 and it’s one of a handful of states with no state income taxes. Even so, the majority of Floridians are burned by their rent (56.8%). Plus, this state had a higher cost of living compared many other states we evaluated.

5. New Jersey

New Jersey took the fifth spot on our list of the worst states for saving money. Despite an impressive median household income of $92,340, more than half of all renters and 33% of homeowners in New Jersey are housing cost burdened.

New Jersey also has one of the highest top marginal state individual income tax rates on our list at 10.75%. These factors, paired with a higher cost of living and DTI than most other states, make the Garden State a tough place to live for Americans hoping to boost their savings.

How to maximize your savings

Even if you don’t live in one of the best states for savers, there are still ways you can maximize your savings. Here are a few tried-and-true savings strategies that work regardless of your ZIP code:

Choose the right type of savings account

Where you keep your savings is just as important as the amount you’re contributing. The national average interest rate for a savings account is only 0.46%, according to the FDIC. However, there are savings options out there that can help your savings grow faster.

For instance, putting your money in a high-yield savings account or certificate of deposit (CD) could help you earn as much as 5% APY or more on your savings. This can help you earn a significant amount of interest over time and hit your savings goals faster. And keep in mind that online banks, which are known for offering competitive rates and low fees, allow you to open an account from anywhere in the U.S.

Lower your tax bill

There are several tax credits and deductions that you may qualify for that can lower your tax liability in April. For example, making extra contributions to your 401(k), IRA, and/or health savings account (HSA) can help lower your taxable income. There are also write-offs related to caring for dependents, working from home, medical expenses, student loan payments, and more.

However, unless you’re a tax expert, you may not know about all of the deductions and credits available to you. Tax software programs are fairly reliable when it comes to finding potential write-offs. But if you’d like the help of a human expert, consider speaking with a tax professional who can help you identify which credits and deductions you can take advantage of at the federal and state level to lower your overall tax bill or increase your refund.

Read more: Wondering what to do with your tax refund? 5 ways to spend it wisely

Pursue a raise

Saving more money isn’t just about trimming your costs — it can also be helpful to look for ways to increase your income. One of the easiest ways to do that is to ask for a raise.

But before you meet with your manager, you’ll need to do some preparation. Begin documenting your accomplishments and concrete ways you’ve contributed to your company’s bottom line. Then present your case for getting a raise when the time is right (such as during a yearend review or following a strong sales quarter).

If a raise isn’t an option, set a date to revisit this conversation with your manager at a later time. You may also want to consider whether it makes sense to look for a new position; strategic job hopping can be an effective way to increase your salary over time.

Downsize your home

Housing costs can place a major financial strain on American households, especially for those in higher cost of living areas.

Whether you’re a renter or a homeowner, downsizing to a more modest home can help trim your monthly rent or mortgage payment, as well as reduce the amount you spend on utilities and maintenance. If it makes sense for your situation, relocating to a new neighborhood or even a new state with a lower cost of living or tax rate can also help you save significantly.

Make saving part of your budget

Contributions to your savings should be considered a monthly expense in your budget. This ensures saving remains a priority and that your savings account grows consistently over time. You may also consider setting up automatic contributions from your checking account to your savings account so you don’t even have to think about it.

Read more: Your complete guide to budgeting for 2024

Look for ways to trim your expenses

The less you spend on unnecessary expenses, the more you can afford to set aside for future savings goals. Take some time to review your monthly budget and your most recent bank statements. Be honest with yourself about which expenses are non-negotiables and which ones you can probably scale back (think: unused subscriptions, takeout orders, shopping, etc.).

Every dollar counts when it comes to saving money and shaving a few dollars of your bottom line each month can make a big difference in your savings account balance.

Read more: How to save money in 2024: 44 tips to grow your wealth

Focus on paying off high-interest debt

Debt can be a drag on your budget, especially your savings account contributions. Carrying debt costs money in interest over time. Prioritize paying off high-interest debt such as credit cards to free up room in your budget. There are many debt repayment strategies you can use to tackle your debt — so find one that works for you.

Read more: What’s more important: Saving money or paying off debt?

Methodology

Our grading system, collected and carefully reviewed by our personal finance experts, comprised more than 400 data points to develop our list of the best and worst states for saving money.

We evaluated all 50 states according to several key metrics, using the most recent data available:

-

Household debt-to-income ratio (DTI): We used publicly available data from 2023, provided by the Federal Reserve, to determine the household DTI for each state. States with a lower DTI ranked higher on our list.

-

Percent of renters and homeowners experiencing housing cost burden: “Housing cost burden” is defined as spending 30% or more of household income on housing costs. We used information from the Population Bureau, sourced from the U.S. Census Bureau’s 2020 ACS Public Use Microdata Sample to determine which states had more housing cost burdened renters and homeowners.

-

Median household income: The median household income is the true “middle” income across all residents where half of all households earn more than the median and half earn less. We favored states with a higher median household income based on 2022 data, the most recent available from the Federal Reserve Bank of St. Louis.

-

Cost of living: Cost of living is defined as the amount of money needed to cover your basic living expenses in a particular area. We favored states with a lower cost of living, based on the Missouri Economic Research and Information Center’s cost of living index for Q1 2024.

-

Effective property tax rate: This is defined as the average amount of residential property taxes actually paid, expressed as a percentage of home value. We favored states with a lower tax rate, based on analysis by the Tax Foundation using the U.S. Census Bureau’s 2021 American Community Survey.

-

State sales tax: Sales tax is a tax imposed on the sale of goods and services. We favored states with a lower sales tax rate, based on analysis by the Tax Foundation.

-

Top marginal state individual income tax rate: We relied on analysis from the Tax Foundation to determine the current maximum statutory income tax rate in each state, based on individual income tax rates, brackets, standard deductions, and personal exemptions for single and joint filers in 2024.

Walgreens sued by shareholder amid plummeting stock price

Dive Brief:

-

Walgreens and its top executives are being sued for allegedly breaching their duty to shareholders by inflating the financial outlook for its pharmacy business, in yet another challenge for the beleaguered retail health giant.

-

Starting last fall, Walgreens CEO Tim Wentworth and CFO Manmohan Mahajan “overstated the Company’s expected revenue for the 2024 Fiscal Year … [and] falsely and materially claimed confidence in the brand inflation, volume growth, cost execution, discipline, and overall contributions of [Walgreens’] pharmacy division,” reads the lawsuit filed on Tuesday in Illinois district court. The lawsuit also names 10 other high-level executives — and Walgreens board chairman Stefano Pessina — as defendants.

-

The suit was filed by Mark Tobias, who has held shares in Walgreens since late 2022. Tobias lodged the lawsuit on behalf of shareholders and the company itself, given its directors are not acting in Walgreens’ best interests, according to the complaint. Tobias is asking that Walgreens be awarded damages from the executives, and take steps to improve corporate governance like increasing board oversight.

Dive Insight:

Walgreens is one of the largest retail pharmacy and healthcare companies in the world, but has struggled amid weakening front-of-store sales and lower reimbursement in its core pharmacy business.

The Deerfield, Illinois-based company tried to resuscitate its flagging financial health through offering more direct healthcare services, including by building out its primary care capabilities, but ran into challenges making the initiative profitable.

Tobias’ lawsuit is rooted in comments and earnings guidance Walgreens published in mid-October last year, during the retailer’s shift to care delivery.

On Oct. 12, Walgreens issued 2024 adjusted earnings per share guidance of $3.20 to $3.50.

On a call with investors the same day, Mahajan said Walgreens’ U.S. retail pharmacy business would be able to improve its operating income thanks to “immediate actions to improve the cost base and modest underlying growth in both retail and pharmacy.” Along with cost cuts, Walgreens’ healthcare delivery business should improve profitability by bringing on new patients, among other actions, Mahajan said.

Those statements were misleading, the lawsuit alleges. With them, “defendants veiled the reality: that [Walgreens’] pharmacy division was not actually equipped to adapt to ongoing hurdles within the industry and the Company would instead require significant restructuring in order to create a sustainable model,” Tobias’ complaint reads.

The price of Walgreens’ stock became artificially inflated as a result, the lawsuit alleges.

Then, on June 27, Walgreens slashed its 2024 adjusted earnings per share guidance to $2.80 to $2.95 when announcing its third quarter results.

Walgreens cited “challenging pharmacy industry trends” as the reason behind the cut.

“The current pharmacy model is not sustainable,” Wentworth said during the company’s call with investors. Following the call, Walgreens’ stock fell more than 22% by the end of the day. It has fallen further since.

Walgreens’ stock has reached its lowest value since the late 1990s

$WBA price at close, Aug. 29, 2014 – Aug. 29, 2024

From October to June, Walgreens misrepresented its operational success to the public, the lawsuit alleges. In addition, during that time the company repurchased millions of shares of common stock at the inflated price, overpaying by $31.5 million — a breach of their fiduciary duties, according to the complaint.

Walgreens is also facing another federal securities fraud lawsuit pending in front of the same Illinois court. The company did not respond to a request for comment for this story.

This story was originally published on Healthcare Dive. To receive daily news and insights, subscribe to our free daily Healthcare Dive newsletter.

Recommended Reading

Nvidia Is No Longer 'Perfect,' But These 18 Stocks Are Still Golden

Before a volatile July, Nvidia (NVDA) earned “perfect” status on this screen highlighting companies sporting the highest possible 99 Composite Rating. But following the artificial intelligence juggernaut’s highly anticipated earnings report, Nvidia stock has seen that rating slip to 96 as it clings to support at its 10-week moving average.

Meanwhile, 18 stocks, including miners Alamos Gold (AGI), Eldorado Gold (EGO), Iamgold (IAG) and Idaho Strategic Resources (IDR), all glow golden with a 99 Composite Rating. Agnico-Eagle Mines (AEM), Newmont (NEM), Silvercorp Metals (SVM) and Harmony Gold Mining (HMY) have also dug their way onto that list.

They are joined by defense stocks Howmet Aerospace (HWM) and Heico (HEI).

↑

X

AI Levels Up: Inside The Chips Driving Nvidia Stock

How Nvidia Is Building A Competitive Moat To Fend Off AI Challengers

Miners And Gold Stocks Lead Top Stocks In Top Groups

All the names on this stock screen hail from the top-ranked industry groups — a factor worth noting because winning stocks tend to come from the top-ranked groups among the 197 industries that IBD tracks. This screen highlights the Top 20 industries.

For example, driven by gold prices, the Mining-Gold/Silver/Gems group ranks a lofty No. 7 among the 197 groups IBD tracks, according to MarketSurge.

Stock Screener Highlights Top-Rated Industry Leaders

| Company | Symbol | Comp Rating | Ind Group Rank | EPS Rating | RS Rating | SMR Rating | A/D Rating |

|---|---|---|---|---|---|---|---|

| Agnico-Eagle Mines | AEM | 99 | 7 | 97 | 95 | B | B+ |

| Alamos Gold | AGI | 99 | 7 | 93 | 92 | A | B+ |

| Bank7 | BSVN | 99 | 15 | 93 | 95 | A | B |

| Eldorado Gold | EGO | 99 | 7 | 87 | 93 | B | A- |

| First Bank (NJ) | FRBA | 99 | 9 | 93 | 88 | A | A- |

| GE Aerospace | GE | 99 | 18 | 84 | 95 | B | B- |

| Heico Corp | HEI | 99 | 18 | 91 | 92 | A | A |

| Heico Cl A | HEIA | 99 | 18 | 91 | 90 | A | A- |

| Harmony Gold Mining | HMY | 99 | 7 | 99 | 97 | A | D+ |

| Howmet Aerospace | HWM | 99 | 18 | 93 | 96 | A | B |

| IamGold | IAG | 99 | 7 | 81 | 97 | B | B+ |

| Idaho Strategic Resources | IDR | 99 | 7 | 81 | 97 | B | A- |

| M-tron Industries | MPTI | 99 | 18 | 99 | 81 | A | C+ |

| Newmont | NEM | 99 | 7 | 88 | 93 | B | B |

| Pennant | PNTG | 99 | 2 | 87 | 98 | A | B+ |

| Silvercorp Metals | SVM | 99 | 7 | 85 | 91 | B | B+ |

| Third Coast Bancshares | TCBX | 99 | 15 | 94 | 92 | A | A- |

| Universal Health | UHS | 99 | 10 | 91 | 95 | B | B+ |

Data as of Aug. 30

Miners Among Best Stocks To Watch

To make this screen of top stocks to watch in the top-ranked industries, each company must meet the following criteria:

However, ratings of course are just one part of the equation when evaluating a stock. Be sure to always check the stock chart to gauge when to buy, sell or hold.

Stock Screener: Build Your Watchlist With Stock Ratings And Stock Lists

Running stock screens with the IBD Stock Screener or MarketSurge is an effective way to streamline your research to find top-rated stocks to watch.

You can also zero in on the best stocks to watch using IBD stocks lists based on a wide range of preset filters. You’ll find top-rated stocks meeting the criteria of the IBD 50, IBD Sector Leaders, IBD Big Cap 20, IPO Leaders and more.

Once you’ve put together potential stock picks for your watchlist, you’ll want to evaluate your ideas with IBD Stock Checkup. With pass, neutral or fail ratings for each of your stocks, IBD Stock Checkup provides a detailed look at both the fundamental and technical health of the companies on your watchlist.

Additionally, based on The IBD Methodology, the Composite Rating provides an overall score that takes into account each of the IBD ratings. The single score considers how a company and its stock are performing in terms of annual and quarterly earnings growth as well as its relative strength vs. the rest of the market. The score also accounts for sales, profit margins and institutional demand.

However, note that you should not buy a stock solely on its ratings or placement on one of IBD’s stock lists. No matter how compelling a company’s story may seem, savvy investors will always check the technical action in the stock chart before buying.

Check The Chart To Know When To Buy Nvidia, Arm And Others

Using stock lists helps you zero in on the best stocks to watch. Stock ratings look under the hood to diagnose a company and its stock’s fundamental and technical health. Both stock lists and stock ratings help you understand what to buy. But to fully understand when to buy stocks, take a look at the stock chart.

Meanwhile, it’s also critical to understand what type of environment you’re currently in. Is it a bull market, when most stocks go up? Or a bear market, when most stocks go down? Or is it a volatile, choppy and uncertain time when the market indexes tend to fail to make any sustained headway?

Use stock charts to evaluate both the market indexes and individual stocks. Charts will help you pinpoint the best time to buy stocks by identifying support and resistance, as well as buy points and buy zones. Using charts also helps you identify warning signs and when to sell stocks.

So when searching for potential stock picks and stocks to watch, always check the charts. They provide the most unbiased diagnosis of a stock’s health.

Follow Matthew Galgani on Twitter at @IBD_MGalgani.

YOU MAY ALSO LIKE:

As Gold Prices Reach Record Highs, Is It Time To Buy Or Sell Gold Stocks, ETFs?

Nvidia Stock Slips Ahead Of Earnings Report (Live Coverage)

One Major Stock Smokes Nvidia — And You Probably Don’t Own It Yet

Generate New Stock Ideas With IBD Stock Screener

Identify Bases And Buy Points With This Pattern Recognition Tool

U.S. stock rally broadens as investors await Fed

By David Randall

NEW YORK (Reuters) – A broadening rally in U.S. stocks is offering an encouraging signal to investors worried about concentration in technology shares, as markets await key jobs data and the Federal Reserve’s expected rate cuts in September.

As the market’s fortunes keep rising and falling with big tech stocks such as Nvidia and Apple, investors are also putting money in less-loved value stocks and small caps, which are expected to benefit from lower interest rates. The Fed is expected to kick off a rate-cutting cycle at its monetary policy meeting on Sept. 17-18.

Many investors view the broadening trend, which picked up steam last month before faltering during an early August sell-off, as a healthy development in a market rally led by a cluster of giant tech names. Chipmaker Nvidia, which has benefited from bets on artificial intelligence, alone has accounted for roughly a quarter of the S&P 500’s year-to-date gain of 18.4%.

“No matter how you slice and dice it you have seen a pretty meaningful broadening out and I think that has legs,” said Liz Ann Sonders, chief investment officer at Charles Schwab.

Value stocks are those of companies trading at a discount on metrics like book value or price-to-earnings and include sectors such as financials and industrials. Some investors believe rallies in these sectors and small caps could go further if the Fed cuts borrowing costs while the economy stays healthy.

The market’s rotation has recently accelerated, with 61% of stocks in the S&P 500 outperforming the index in the past month, compared to 14% outperforming over the past year, Charles Schwab data showed.

Meanwhile, the so-called Magnificent Seven group of tech giants – which includes Nvidia, Tesla and Microsoft – have underperformed the other 493 stocks in the S&P 500 by 14 percentage points since the release of a weaker-than-expected U.S. inflation report on July 11, according to an analysis by BofA Global Research.

Stocks have also held up after an Nvidia forecast failed to meet lofty investor expectations earlier this week, another sign that investors may be looking beyond tech. The equal weight S&P 500 index, a proxy for the average stock, hit a fresh record this week and is up around 10.5% year-to-date, narrowing its performance gap with the S&P 500.

“When market breadth is improving, the message is that an increasing number of stocks are rallying on expectations that economic conditions will support earnings growth and profitability,” analysts at Ned David Research wrote.

Value stocks that have performed well this year include General Electric and midstream energy company Targa Resources, which are up 70% and 68%, respectively. The small-cap focused Russell 2000 index, meanwhile, is up 8.5% from its lows of the month, though it has not breached its July peak.

Next Friday’s non-farm payrolls report could help bolster the case for a broader market rally if it shows the labor market is cooling at a steady, though not alarming pace, said David Lefkowitz, head of U.S. Equities for UBS Global Wealth Management.

The jobs report “tends to be one of the more market moving releases in general, and right now it’s going to get even more attention than normal.”

Investors are unlikely to turn their back on tech stocks, particularly if volatility gives them a chance to buy on the cheap, said Jason Alonzo, a portfolio manager with Harbor Capital.

Technology stocks are expected to post above-market earnings growth over every quarter through 2025, with third-quarter earnings coming in at 15.3% compared with a 7.5% gain for the S&P 500 as a whole, according to LSEG data.

“People will sometimes take a deep breath after a nice run and look at other opportunities, but technology is still the clearest driver of growth, particularly the AI theme which is innocent until proven guilty,” Alonzo said.

(Reporting by David Randall; Editing by Ira Iosebashvili and Richard Chang)

GM must face big class action over faulty transmissions

By Jonathan Stempel

(Reuters) – General Motors (GM) was ordered by a federal appeals court to face a class action claiming it violated laws of 26 U.S. states by knowingly selling several hundred thousand cars, trucks and SUVs with faulty transmissions.

The 6th U.S. Circuit Court of Appeals said a lower court judge had discretion to let drivers sue in groups over Cadillac, Chevrolet and GMC vehicles equipped with 8L45 or 8L90 eight-speed automatic transmissions, and sold in the 2015 through 2019 model years.

Drivers said the vehicles shudder and shake in higher gears, and hesitate and lurch in lower gears, even after repair attempts. They also accused GM of telling dealers to provide assurance that harsh shifts were “normal.”

GM did not immediately respond on Thursday to requests for comment. The decision was issued on Wednesday by a three-judge panel of the Cincinnati-based appeals court.

Class actions can result in greater recoveries at lower cost than if plaintiffs were forced to sue individually.

The GM litigation covers about 800,000 vehicles, including 514,000 in the certified classes.

Vehicles include the Cadillac CTS, CT6 and Escalade; Chevrolet Camaro, Colorado, Corvette and Silverado; and GMC Canyon, Sierra and Yukon, among others.

In opposing class certification, GM said most class members never experienced problems and therefore lacked standing to sue.

It also said there were too many differences among class members to justify group lawsuits.

Circuit Judge Karen Nelson Moore, however, said overpaying for allegedly defective vehicles was enough to establish standing.

She also said “exactly how, and to what extent, each of the individual plaintiffs experienced a shudder or shift quality issue is irrelevant” to whether GM concealed known defects, and whether drivers would have found that information material.

The court also rejected GM’s argument that many potential claims belonged in arbitration.

It returned the case to U.S. District Judge David Lawson in Detroit, who certified the classes in March 2023.

“We look forward to holding GM accountable before a Michigan jury,” Ted Leopold, a Cohen Milstein Sellers & Toll partner representing the drivers, said in a statement.

The case is Speerly et al v. General Motors LLC, 6th U.S. Circuit Court of Appeals, No. 23-1940.

(Reporting by Jonathan Stempel in New York; Editing by Nick Zieminski)

Ready To Retire On A Single Magnificent 7 Stock? Poll Reveals Top Pick —And It's Not Apple

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Investors have many options when it comes to investing for retirement.

Among the available strategies are to invest in index funds, mutual funds, ETFs or choose individual stocks. Benzinga recently asked which of the Magnificent 7 stocks was the best option for retirement.

What Happened: The Magnificent 7 stocks, a select group of highly valuable and widely recognized investments, are often associated with high-growth financials and leading companies in the technology sector.

The Magnificent 7 stocks are Apple (NASDAQ:APPL), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL), Meta Platforms (NASDAQ:META), Microsoft Corporation (NASDAQ:MSFT), NVIDIA Corporation (NASDAQ:NVDA) and Tesla (NASDAQ:TSLA).

Trending Now:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

“If you had to invest your entire retirement account into just one Magnificent 7 stock, which would you choose?” Benzinga asked.

Here are the results:

Nvidia: 33%

Apple: 21%

Microsoft: 17%

Amazon: 14%

Tesla: 7%

Alphabet: 4%

Meta Platforms: 4%

The results are hardly surprising given Nvidia’s status as one of the most talked-about growth stories in recent years, with the stock significantly outperforming over the past year.

Apple ranked second in the poll and comes as the company is among the top performers over the last five years and has a loyal fan base.

Why It’s Important: The Magnificent 7 stocks have outperformed the broader stock market over the last five years and 10 years based on the returns compared to the SPDR S&P 500 ETF Trust (NYSE:SPY), which tracks the S&P 500.

Here’s a look at the five-year and 10-year returns of the Magnificent 7 stocks:

|

Stock |

5-Year Returns |

10-Year Returns |

|

Nvidia |

+2,962% |

+25,603% |

|

Apple |

+337% |

+822% |

|

Microsoft |

+200% |

+802% |

|

Amazon |

+95% |

+900% |

|

Tesla |

+1,291% |

+1,031% |

|

Alphabet |

+177% |

+451% |

|

Meta |

+180% |

+572% |

Read More:

For comparison, the SPDR S&P 500 ETF is up 92% over the last five years and up 179% over the last 10 years. Each of the Magnificent 7 stocks beats the ETF for both time periods, with many more than doubling its returns.

Nvidia recently topped a poll on which Magnificent 7 stock Benzinga readers would invest $1,000 in today. It was Amazon.com that topped Nvidia in a poll on which Magnificent 7 stock could best weather a recession.

For investors looking to get exposure to all the Magnificent 7 stocks, there is also the Roundhill Magnificent Seven ETF (NASDAQ:MAGS) which holds the seven companies.

The study was conducted by Benzinga on Aug. 26 and Aug. 27, 2024, and included the responses of a diverse population of adults 18 or older. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 112 adults.

A 9% Return In Just 3 Months

EquityMultiple’s ‘Alpine Note — Basecamp Series’ is turning heads and opening wallets. This short-term note investment offers investors a 9% rate of return (APY) with just a 3 month term and $5K minimum. The Basecamp rate is at a significant spread to t-bills. This healthy rate of return won’t last long. With the Fed poised to cut interest rates in the near future, now could be the time to lock in a favorable rate of return with a flexible, relatively liquid investment option.

What’s more, Alpine Note — Basecamp can be rolled into another Alpine Note for compounding returns, or into another of EquityMultiple’s rigorously vetted real estate investments, which also carry a minimum investment of just $5K. Basecamp is exclusively open to new investors on the EquityMultiple platform.

Looking for fractional real estate investment opportunities? The Benzinga Real Estate Screener features the latest offerings.

This article Ready To Retire On A Single Magnificent 7 Stock? Poll Reveals Top Pick —And It’s Not Apple originally appeared on Benzinga.com

3 Magnificent Stocks That Created Many Millionaires and Will Continue to Make More

One of the coolest parts about investing is that there are a variety of ways to reach your goal. It doesn’t matter whether you prefer high-flying growth stocks or slow and steady dividend stocks; you can build wealth with almost any strategy. The most important thing is buying stocks representing high-quality companies. A quality business steadily grows and creates value for its shareholders, making you wealthy over time.

One stumbling block for this investing strategy is the propensity to overthink investing. Overthinking can sometimes cause investors to pass on proven winners to instead focus on riskier stocks that might be successful.

Here are three magnificent stocks that have made people rich and have the ingredients to do it for you as well.

1. Amazon

E-commerce and technology company Amazon (NASDAQ: AMZN) is the textbook example of a millionaire-making stock. Its shares have returned over 179,000% since its IPO in 1997. How? By dominating colossal market opportunities. Amazon started as an online bookstore in the earliest days of e-commerce. Today, Amazon sells virtually anything you could think of and controls almost 40% of online sales in the United States. However, Amazon didn’t stop there; its innovative culture led it to sell its IT infrastructure to the public as AWS, the world’s leading cloud platform today. Roughly 200 million households subscribe to Amazon’s monthly Prime membership, which it has used to build growing businesses in advertising and streaming entertainment content.

Amazon’s massive size gives it cost advantages against most competitors across its business models. Additionally, these various businesses have room to keep growing for the foreseeable future. For example, online shopping is still just 16% of total retail sales in America. Meanwhile, global cloud infrastructure spending is poised to grow by nearly 20% annually over the coming years on cloud computing and artificial intelligence (AI) demand.

Analysts believe the company’s earnings will increase by 27% annually over the long term, which means this multitrillion-dollar company should continue compounding wealth for those holding the stock.

2. Chipotle Mexican Grill

Successful companies are frequently boring; Chipotle Mexican Grill (NYSE: CMG) sells burritos and rice bowls to hungry customers. Yet, the stock has appreciated over 6,000% since going public in 2006. Chipotle’s fresh and popular products have fueled steady store expansion for three decades. Today, the company owns and operates roughly 3,146 stores (primarily) in the United States and international markets like Canada and the United Kingdom. The company splits its profits between opening stores and repurchasing its stock to help boost earnings per share, ultimately helping drive its share price higher. Chipotle has reduced its share count by nearly 12% over the past decade.

The great thing about a business like this is that it’s predictable. Chipotle shouldn’t have any problems continuing its success as long as people still enjoy its food. More mature restaurant chains have thousands more stores, meaning Chipotle can continue opening stores for years. Its Tex-Mex cuisine is also popular worldwide, so international markets could play a more significant role in Chipotle’s growth as its footprint in the U.S. market matures. Analysts believe Chipotle can grow earnings by 22% annually moving forward, so there is still plenty of upside ahead for long-term investors.

3. Coca-Cola

Beverage giant Coca-Cola (NYSE: KO) is a Warren Buffett favorite and bona fide wealth-building machine. Coca-Cola doesn’t grow fast, but the slow and steady winner has returned over 12,000% in total gains to investors since the early 1970s. The company sells dozens of brands of soda, water, juices, tea, and other beverages worldwide through grocery stores, vending machines, restaurants, and just about anywhere you might find a drink. Coca-Cola is highly profitable, so it shares its profits with investors via dividends. The company has paid and raised its dividend for 62 consecutive years. Want to get the most out of Coca-Cola stock? Buy, hold, and reinvest those dividends to buy more shares.

It’s a boring company, but you might regret passing on it. Although Coca-Cola is not fast-growing, it still has a tremendous runway for long-term expansion. The beverage industry is so fragmented that an estimated 70% of consumers in developed countries still don’t drink a Coca-Cola product more than once a week. The penetration is even lower in emerging markets like Africa, India, and Latin America. Coca-Cola’s brands are known worldwide, so the company should tap into that growth as economies mature and consumers have the discretionary income for things like packaged beverages. Analysts believe Coca-Cola will grow earnings by 6% annually over the long term, adding to the stock’s nearly 3% dividend yield.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $769,685!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Chipotle Mexican Grill. The Motley Fool recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

3 Magnificent Stocks That Created Many Millionaires and Will Continue to Make More was originally published by The Motley Fool