With just two days until July 9, markets face a pivotal moment. President Trump has signed “take-it-or-leave-it” letters to 12 countries, warning that if negotiations stall, a sweeping set of tariffs will automatically kick in—reverting rates back to 11–50% on key imports. As traders position ahead of this deadline, a sense of complacency has set in—despite rising geopolitical risk.

Letters Going Out Monday: What Traders Need to Know

On Monday morning, 12 nations will receive official tariff notices, detailing the specific rates their exports to the U.S. will face unless deals are struck. President Trump confirmed the letters are signed and set to dispatch on the 90-day pause’s final day. These countries include key partners such as Japan, India, the EU, and South Korea.

Treasury Secretary Scott Bessent emphasized that only Trump can decide whether to extend the deadline. He anticipates a “flurry” of last-minute deals but warned that countries failing to negotiate in good faith could face the full tariffs on August 1.

Who’s on the Hook—and What’s at Stake

Early indications suggest India may be close to a deal, potentially averting steep tariffs. In contrast, negotiations with Japan are faltering, prompting talk of auto tariffs as high as 35%, and its rice import refusal only heightening tension.

The European Union is reportedly open to a “modest deal” that would leave U.S. tariffs at 10% in exchange for cuts in areas like pharmaceuticals and aircraft, though nothing is finalized. So far, only the UK and China appear to have secured agreements under the pause.

Commerce Dept Confirms August 1 Deadline

The Commerce Department has confirmed that if no agreement is reached by July 9, new tariffs will begin rolling out August 1. This gives a narrow window: countries will receive letters Monday, and unless resolutions emerge in 30 days, the tariffs take effect.

Traders are buzzing over what’s being called “The Downtime Before the Storm”—a brief calm before what could become a storm of rate adjustments and policy reversals.

Market Complacency vs. Rising Risk

Despite the ticking clock, equity markets haven’t flinched. The S&P 500 has erased earlier tariff worries and sits near record highs, with traders betting on last-minute deals or deadline extensions. Volatility indicators remain muted, suggesting the market is expecting smooth sailing.

But analysts caution this could be dangerous complacency. As one strategist put it: markets are breezing through a high-risk global policy redline without flinching. A deal falling through or a surprise escalation could trigger sharp losses in equities, bond yields, and emerging-market currencies.

Strategic Pivot: Narrow Deals Over Broad Pacts

Administration insiders suggest a shift from grand trade deals to phased, narrow-based agreements to meet the July 9 deadline. Instead of sweeping tariffs and reciprocal access deals, the focus is now on achievable sectoral accords—for example, auto parts with India or agricultural goods with Vietnam.

This approach deviates sharply from the original promise of “90 deals in 90 days.” The shift may reduce the chance of full-scale protectionism—but it also introduces volatility around uncertain sector-specific outcomes.

How Traders Are Positioning

Market players are hedging ahead of Monday’s letter drop:

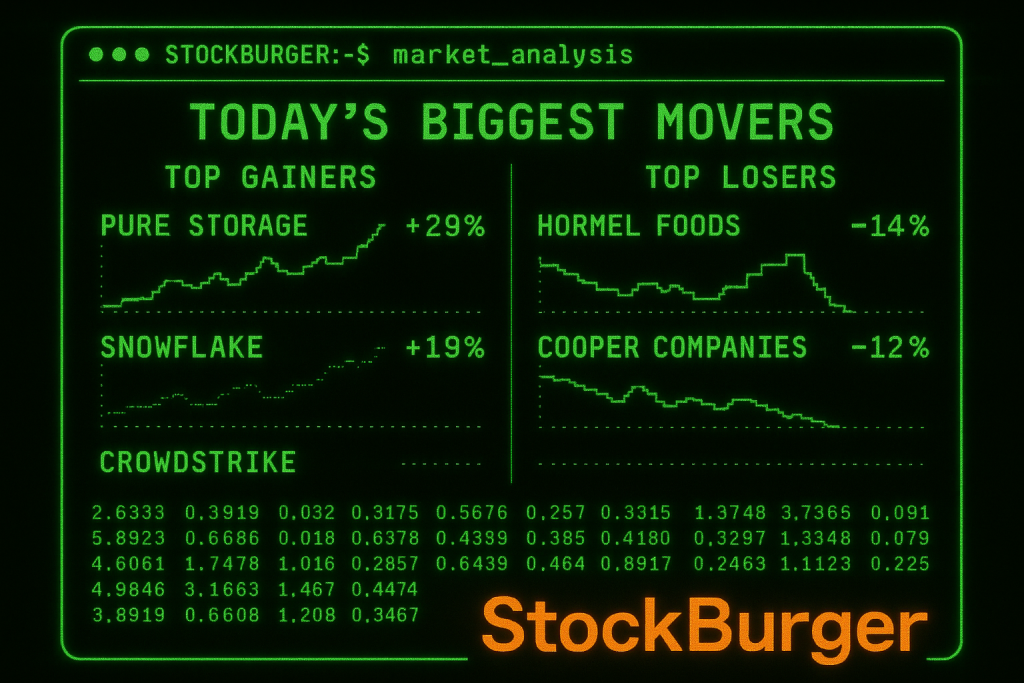

- Equities: Sticky near highs, but cyclical sectors (industrials, materials) have been gaining ground as a hedge.

- Bonds: Yields have edged higher on elevated risk—hedging against escalating global trade disruptions.

- FX: The dollar remains under pressure, notably against the yen and euro, as currency markets are already anticipating policy moves.

Some hedge funds are building short positions in U.S. equities, expecting a knee-jerk sell-off if talks unravel.

What to Watch Next Week

- Monday morning – Letters hit inboxes in Tokyo, Brussels, Delhi, and Seoul—some countries will go public immediately.

- Negotiation updates – Watch for diplomatic meetings or press releases signaling breakthroughs, even tentative ones.

- Market reaction – Sharp moves in rate-sensitive sectors like autos, steel, semiconductors, and agriculture.

- Policy statements – Administration comments or Bessent remarks could set the tone on extensions or escalation.

Final Thought

In the next 48 hours, markets will be stress-tested more than in weeks. With tariff letters arriving, the August 1 implementation date looming, and markets numb to risk, traders face a true litmus test: a seamless deal could reinforce investor confidence—but anything less could ignite a swift, multi-asset selloff.

As the clock ticks toward July 9, one thing is clear: in trade policy, complacency is the riskiest bet of all.