The Stock Market Just Did Something Last Seen in 1998. History Says This Will Happen in 2025.

The S&P 500 (SNPINDEX: ^GSPC) is widely regarded as the single best gauge for the overall U.S. stock market. That's because its 500 member companies cover approximately 80% of domestic equities by market value, and the index includes value stocks and growth stocks from all 11 stock market sectors.

The S&P 500 has advanced 24% year to date, as of Dec. 30, propelled upward by strong economic growth and enthusiasm about artificial intelligence (AI). That means the index has returned more than 20% in two consecutive calendar years, something it last did in 1998. While that momentum bodes well for 2025, high valuations may create turbulence in the new year.

Here's what investors need to know.

The S&P 500 has only increased more than 20% in back-to-back years three times since it was created in 1957. All three incidents were clustered together in close proximity to the dot-com bubble.

The chart below shows how the S&P 500 performed during the 12 months following two-year periods in which the index gained more than 20% in both years.

| Two-Year Periods With S&P 500 Returns Above 20% in Both Years | S&P 500 Return (Next 12 Months) |

|---|---|

| 1995 and 1996 | 31% |

| 1996 and 1997 | 27% |

| 1997 and 1998 | 20% |

| Average | 26% |

Data source: YCharts. Chart by author.

As shown above, the S&P 500 has returned an average of 26% during the 12-month period following back-to-back calendar years with gains above 20%. That supports the Wall Street aphorism that momentum in the stock market begets more momentum.

The chart implies the S&P 500 could advance 26% in 2025. But what the chart doesn't show is the market crash that followed the dot-com bubble. After peaking in March 2000, the S&P 500 plunged nearly 50% as investors realized many internet start-ups traded at absurd valuations.

To be clear, I don't believe the artificial intelligence boom is a repeat of the dot-com bubble. For one reason, the "Magnificent Seven" stocks have much cheaper valuations, compared to the largest technology stocks in the late 1990s. But cheaper isn't the same as cheap. The stock market is very expensive today, and that could lead to trouble in 2025.

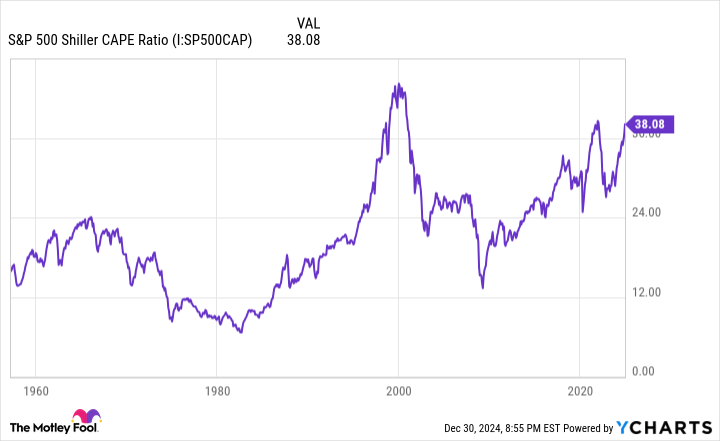

The cyclically adjusted price-to-earnings ratio (CAPE) is often used to value the S&P 500. Investors may know the metric by another name, the Shiller P/E, because it was developed by Nobel Prize-winning economist and former Yale Professor Robert Shiller.

Breaking news

See all