Deep-pocketed investors have adopted a bullish approach towards Carvana CVNA, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CVNA usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 59 extraordinary options activities for Carvana. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 38% bearish. Among these notable options, 46 are puts, totaling $3,416,972, and 13 are calls, amounting to $1,001,995.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $300.0 for Carvana over the recent three months.

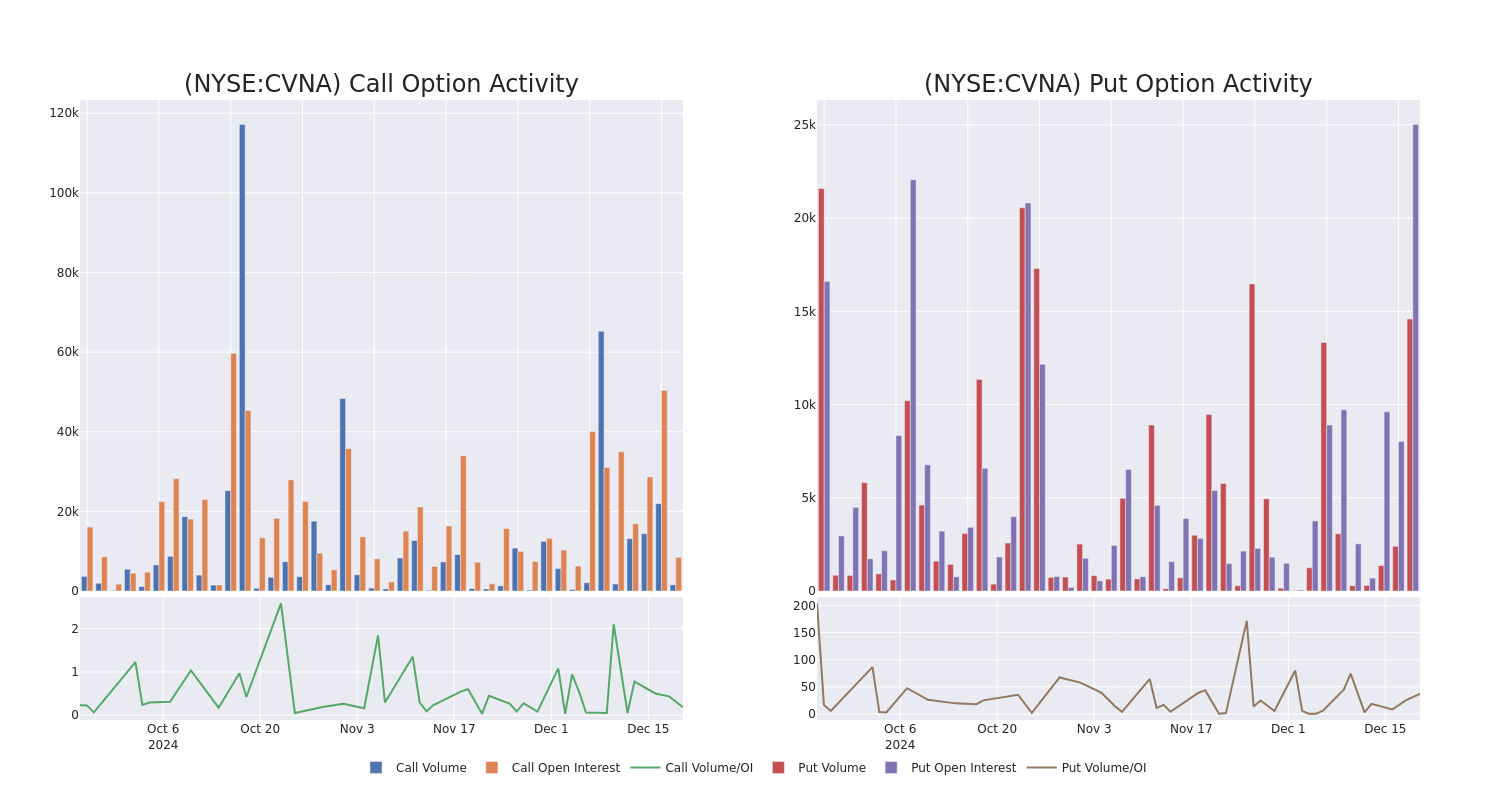

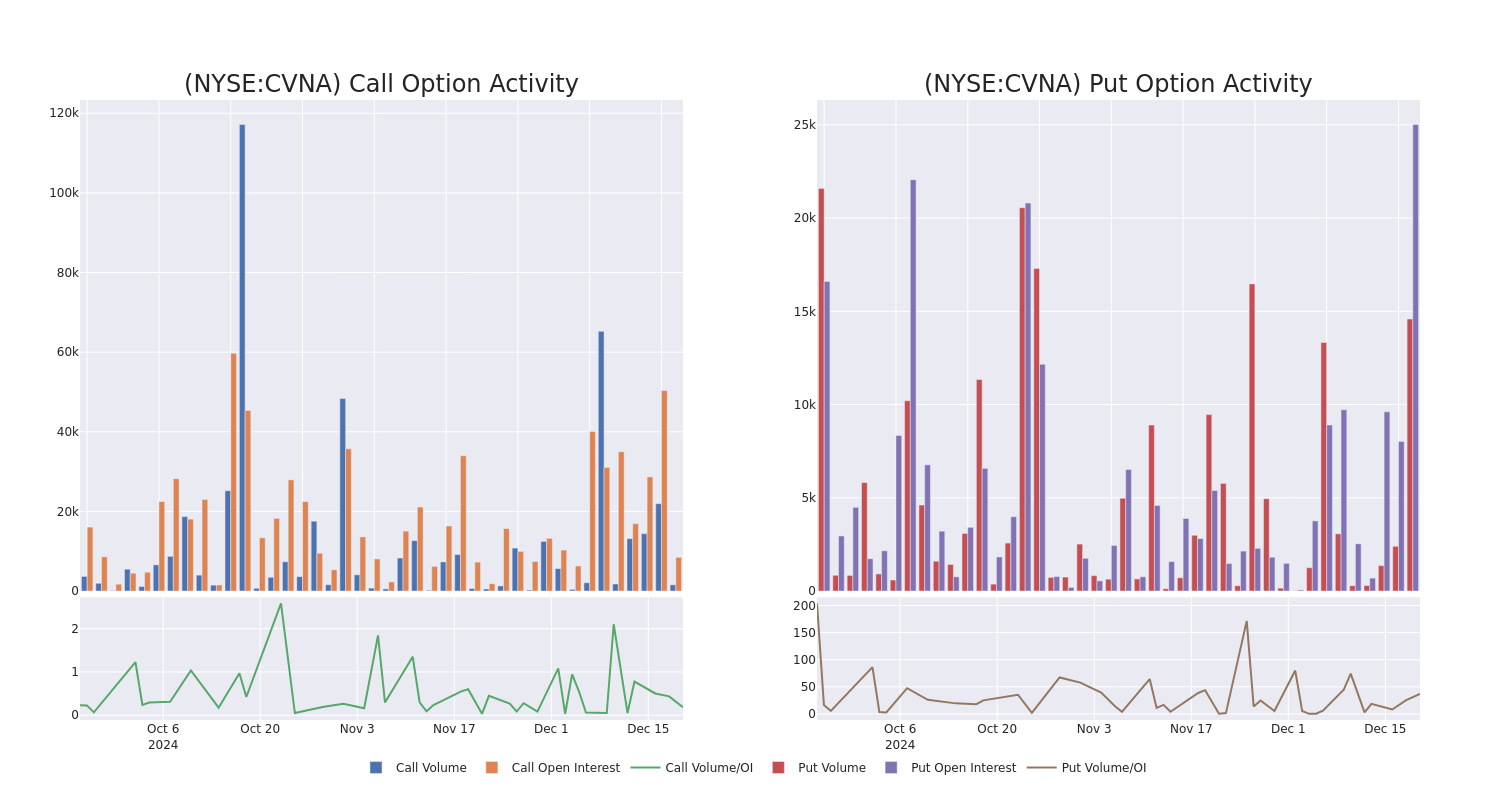

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Carvana's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Carvana's whale activity within a strike price range from $60.0 to $300.0 in the last 30 days.

Carvana Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVNA | PUT | TRADE | BEARISH | 01/17/25 | $8.2 | $7.15 | $8.0 | $200.00 | $800.0K | 6.3K | 1.6K |

| CVNA | CALL | TRADE | BEARISH | 01/17/25 | $163.35 | $161.2 | $161.2 | $60.00 | $290.1K | 2.2K | 31 |

| CVNA | PUT | TRADE | NEUTRAL | 01/17/25 | $15.0 | $13.5 | $14.25 | $220.00 | $285.0K | 3.6K | 208 |

| CVNA | PUT | TRADE | BEARISH | 01/17/25 | $7.95 | $7.1 | $7.72 | $200.00 | $154.4K | 6.3K | 669 |

| CVNA | PUT | TRADE | BEARISH | 06/20/25 | $56.95 | $56.5 | $56.95 | $250.00 | $142.3K | 45 | 101 |

About Carvana

Carvana Co is an e-commerce platform for buying and selling used cars. The company derives revenue from used vehicle sales, wholesale vehicle sales and other sales and revenues. The other sales and revenues include sales of loans originated and sold in securitization transactions or to financing partners, commissions received on VSCs and sales of GAP waiver coverage. The foundation of the business is retail vehicle unit sales. This drives the majority of the revenue and allows the company to capture additional revenue streams associated with financing, VSCs, auto insurance and GAP waiver coverage, as well as trade-in vehicles.

Carvana's Current Market Status

- Trading volume stands at 2,238,104, with CVNA's price down by -0.48%, positioned at $221.91.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 62 days.

Professional Analyst Ratings for Carvana

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $298.3333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Needham has decided to maintain their Buy rating on Carvana, which currently sits at a price target of $330. * Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Carvana, targeting a price of $245. * An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $320.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carvana options trades with real-time alerts from Benzinga Pro.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.