August 27, 2025 – Market Close Analysis

🚀 Today’s Earnings Highlights

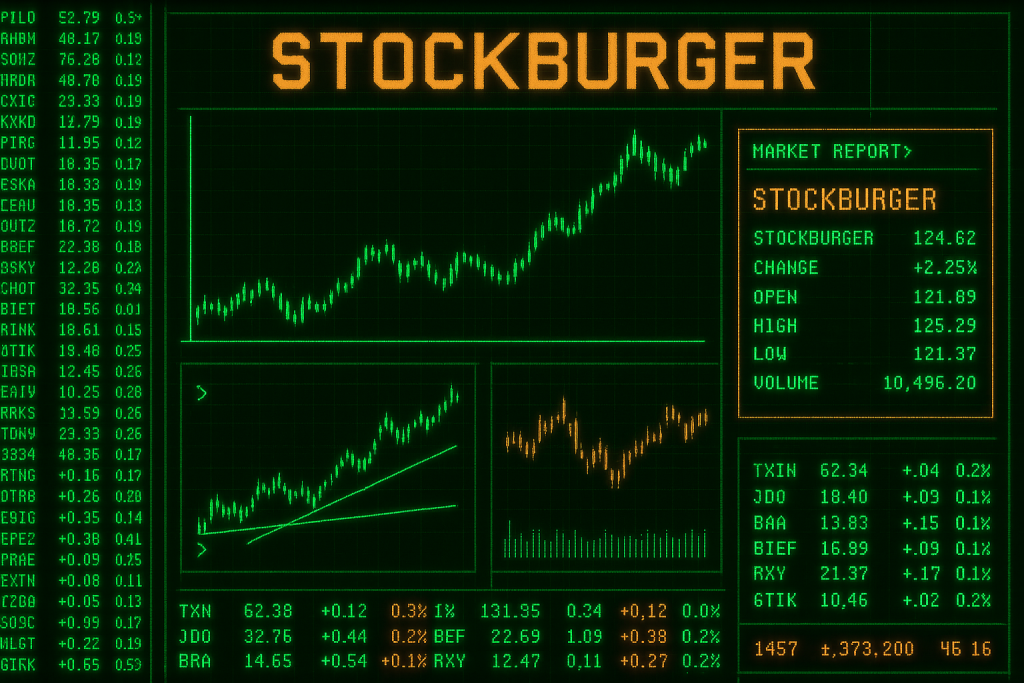

Today’s earnings reports showcased the resilience of major corporations as they navigate an evolving economic landscape. More than a dozen prominent companies reported results, covering sectors from tech and retail to finance and industrials. Many names delivered substantial beats on both revenue and profit, hinting at a broader recovery across cyclical and growth segments despite lingering macro headwinds. The numbers reveal expanding margins in technology, same-store sales outpacing inflation in consumer discretionary, and solid interest income in financials. Major indices responded favorably, closing near daily highs and suggesting investor confidence in corporate fundamentals.

Several management teams emphasized the importance of cost discipline, supply-chain redesigns, and strategic capital allocation. At the same time, they are betting on innovation and new product cycles to sustain momentum. Companies continue to navigate geopolitical complexities, fluctuating commodity prices, and evolving consumer behaviors. However, the breadth of earnings beats and positive guidance offered signals that corporate America remains more adaptable than previously feared. As a result, investors are finding cause for optimism even as central banks maintain a cautious stance.

⚡ STOCKBURGER RESEARCH TEAM

Delivering actionable investment insights for the modern trader

📈 Key Earnings Winners

Technology Sector Leadership

The technology sector delivered another strong quarter, fueled by cloud computing momentum, artificial intelligence adoption, and resilient software demand. Enterprise clients accelerated spending on data analytics tools and cybersecurity suites, driving double-digit growth for leading SaaS providers. Hardware companies highlighted robust orders for next-generation servers and consumer devices ahead of the holiday cycle. Meanwhile, semiconductor giants reported double-digit revenue growth on continued AI chip demand and limited supply constraints. Management teams remain upbeat, projecting elevated capital expenditures in data infrastructure through 2026.

One notable theme is the pivot to subscription-based models. Mature hardware names are seeing higher margins as they bundle maintenance and AI services with core products. Investors applauded guidance targeting low-teens revenue growth next fiscal year. Several companies also announced new partnerships with cloud providers to speed AI adoption and custom solutions for regulated industries. In short, the technology sector continues to lead the market, offering a mix of growth and profitability that investors crave even in uncertain macro environments.

Consumer Discretionary Resilience

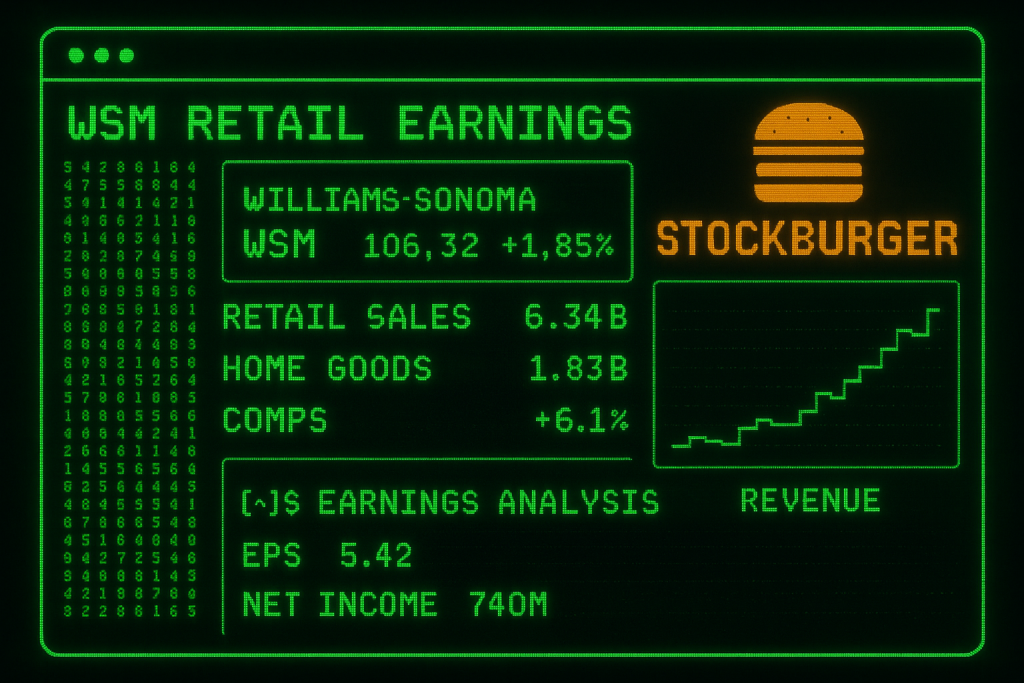

Retailers once again proved their resilience, reporting better-than-expected same-store sales growth and strong online engagement. Apparel and specialty retailers noted higher conversion rates, consistent demand for premium SKUs, and normalized inventory levels, supporting margin expansion. Home furnishing brands benefited from steady home improvement trends and disciplined promotional strategies. Notably, companies said consumers remain willing to spend on quality and brand-driven products despite inflationary pressures.

Digital sales continued to play a key role. Retailers that invested early in digital ecosystems reported lower customer acquisition costs and higher repeat purchases. Some offered integrated loyalty programs that rewarded cross-category shopping, boosting per-customer revenue. Looking ahead, management teams signaled targeted store expansions in high-growth urban markets and continued investment in supply-chain automation. The sector is buoyed by consumers’ comfort with digital-first shopping experiences and a healthy labor market, giving retailers more visibility heading into the critical holiday season.

Financial Services Stability

Banks and financial service companies delivered steady results thanks to rising net interest income and manageable credit losses. The higher-rate environment expanded lending margins, offsetting lower mortgage origination volumes and modest trading activity. In wealth management, advisory fees remained robust as clients rebalanced portfolios toward higher-yield instruments. Asset managers cited record inflows into diversified bond funds and alternative strategies.

Executives said credit quality remains strong, with delinquencies and charge-offs below pre-pandemic averages. Nonetheless, banks increased reserves slightly to account for macro uncertainty and potential consumer stress. Many institutions outlined renewed cost discipline, reducing non-core expenses while continuing to invest in digital banking and embedded finance platforms. Analysts see opportunity in regional banks poised to gain share in commercial lending and business banking as small and medium enterprises invest in capacity expansions. Despite regulatory scrutiny, the broader outlook remains constructive for financials in 2025.

“Today’s earnings reports demonstrate the underlying strength of corporate America, with companies showing remarkable adaptability in challenging market conditions.” — StockBurger Research Team

💡 Market Implications

Positive Indicators:

- Revenue growth exceeding expectations across multiple sectors

- Margin expansion in technology and healthcare

- Strong forward guidance from market leaders

- Continued investment in innovation and growth initiatives

These positives suggest corporate America is navigating high interest rates and geopolitical headwinds with precision. Even cyclical names exhibited disciplined cost management and strategic pricing power. The breadth of upward revisions to earnings guidance further underscores that demand remains healthy across B2B and consumer-facing industries.

Areas of Caution:

- Supply chain pressures in manufacturing

- Labor cost inflation impacting margins

- Currency headwinds for multinational corporations

Persistent supply bottlenecks mean that certain industrials and consumer goods companies face longer lead times and raw material volatility. Meanwhile, wage pressures threaten profit margins for labor-intensive businesses. Large multinationals warned that a strong dollar could temper overseas earnings. These factors merit close monitoring as they may weigh on margins if inflation persists or global demand softens.

🎯 Investment Strategy

Based on today’s earnings results, a balanced approach appears prudent. Investors should weigh growth opportunities against value plays and defensive positions. Here’s a framework to consider:

Growth Opportunities: Investors can look toward technology companies with strong AI and cloud exposure. These names benefit from secular tailwinds and recurring revenue streams, and their robust balance sheets offer cushion against macro shocks. Focus on businesses with expanding gross margins, accelerating customer adoption, and robust free-cash-flow generation.

Value Plays: Financial services stocks with improving fundamentals may provide a favorable risk-reward. Rising net interest income supports profitability, while disciplined cost management and healthy capital ratios reduce downside risk. High-quality regional banks and diversified asset managers offer attractive dividend yields and potential for multiple expansion as credit markets remain benign.

Defensive Positions: Consumer staples companies with pricing power stand out in an environment of persistent inflation and elevated geopolitical risk. These businesses maintain consistent demand, even in downturns, and they can pass cost increases along without losing customers. Health care names with stable cash flows and robust innovation pipelines may also serve as ballast in portfolios.

📊 Market Outlook

Looking ahead, the cross-currents of resilient corporate earnings and macro headwinds create a nuanced backdrop. On one hand, businesses are clearly adept at navigating inflation, supply disruptions, and geopolitical tensions. Earnings trends show companies have access to capital, skilled labor, and innovation pathways. On the other hand, persistent inflation, tight labor markets, and potential policy shifts mean vigilance remains essential.

Investors should continue to monitor central bank signals, fiscal policy debates, and geopolitical developments. Corporate margins could face pressure if cost inflation accelerates, while a slowing global economy could dampen demand for industrial and consumer goods. That said, record levels of corporate cash and strong cash flows provide a margin of safety. Companies with disciplined capital allocation and high-return growth projects will likely deliver premium returns.

Overall, today’s earnings reports provide a constructive foundation for continued market advancement. Companies demonstrating operational excellence and strategic vision are well-positioned for sustained growth. Diversified portfolios that blend growth, value, and defensive holdings can navigate near-term volatility while capturing upside as the economy evolves.

Risk Disclaimer: This analysis is for informational purposes only and not financial advice. Past performance does not guarantee future results. Always conduct your own research or consult a licensed financial advisor before making investment decisions.