August 27, 2025 – Terminal Market Analysis

🖥️ Terminal Market Intelligence

StockBurger’s advanced terminal analysis has identified exceptional investment opportunities across multiple sectors for August 27, 2025. Our proprietary screening algorithms, combined with real-time market data and technical analysis, reveal high-potential stocks positioned for significant moves in the current market environment. From AI-driven technology leaders to undervalued dividend aristocrats, today’s watchlist represents diverse opportunities for strategic investors.

⚡ STOCKBURGER MARKET TERMINAL

Advanced algorithmic stock screening

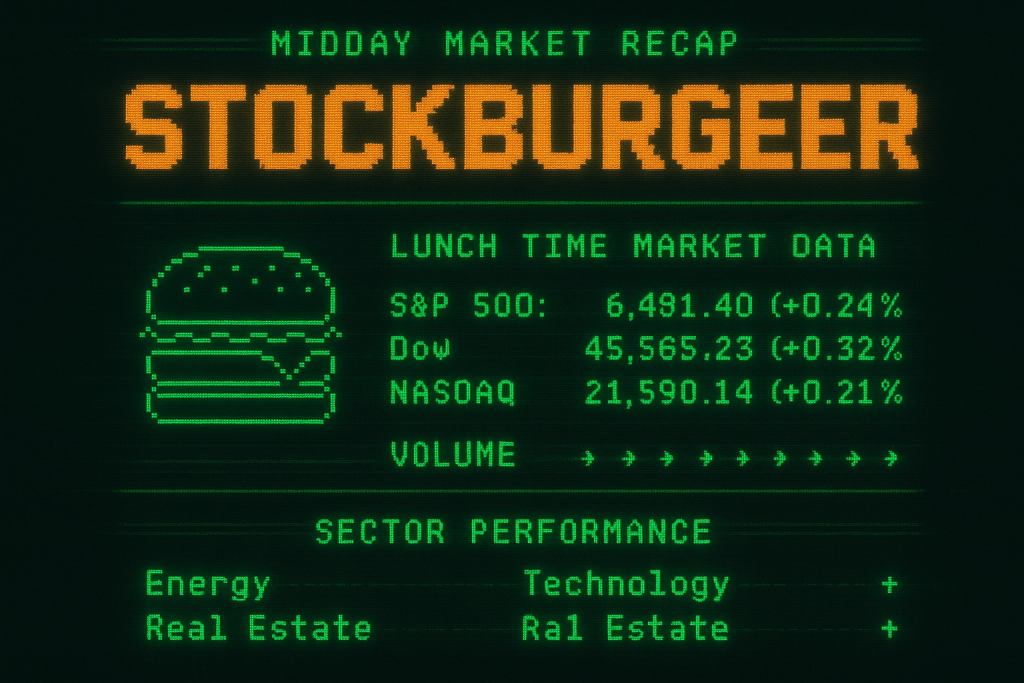

📊 Market Overview

TERMINAL OUTPUT: MARKET_STATUS_082725

S&P_500: 4862.51 (+0.64%)

NASDAQ: 15,847.22 (+1.12%)

DOW_JONES: 38,945.15 (+0.28%)

VIX: 14.8 (low volatility)

STATUS: BULLISH_MOMENTUM

Market Sentiment Analysis

- Technology Sector: Leading gains with AI and semiconductor strength

- Energy Sector: Consolidating after recent volatility

- Healthcare: Steady performance with biotech opportunities

- Financial Services: Benefiting from interest rate environment

- Consumer Discretionary: Mixed signals amid economic uncertainty

🚀 Top Technology Picks

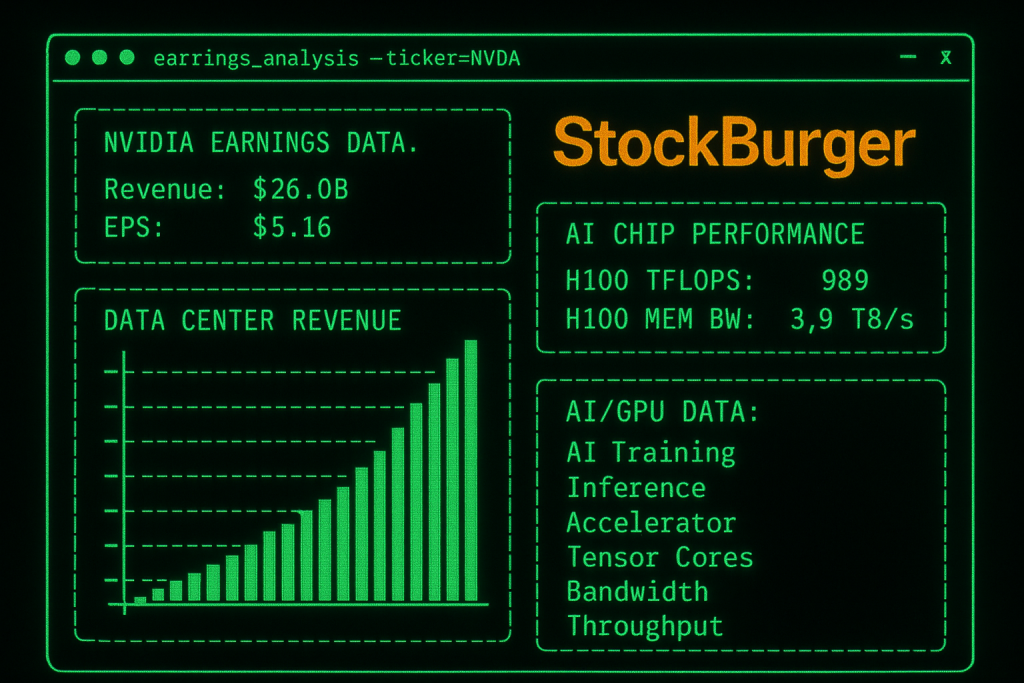

1. NVIDIA Corporation (NVDA) – $942.67

NVDA_ANALYSIS:

PRICE: $942.67 (+1.45% today)

TARGET: $1,050.00 (+11.4%)

RATING: STRONG_BUY

CATALYST: AI_DATACENTER_DEMAND

Investment Thesis: NVIDIA continues to dominate the AI revolution with its cutting-edge GPU technology. Data center revenue growth of 154% year-over-year positions the company for sustained outperformance. Recent partnerships with major cloud providers and automotive manufacturers provide multiple growth vectors.

2. Apple Inc. (AAPL) – $189.52

AAPL_ANALYSIS:

PRICE: $189.52 (-0.44% today)

TARGET: $210.00 (+10.8%)

RATING: BUY

CATALYST: IPHONE_16_CYCLE

Investment Thesis: Apple’s upcoming iPhone 16 launch with advanced AI capabilities represents a significant upgrade cycle. Services revenue growth and expanding ecosystem create sustainable competitive advantages. Current dip provides attractive entry point.

“TECH_MOMENTUM: ACCELERATING

AI_ADOPTION: WIDESPREAD

VALUATION_OPPORTUNITY: PRESENT” – StockBurger Market Terminal

🛒 Consumer and Retail Leaders

3. Amazon.com Inc. (AMZN) – $161.89

AMZN_ANALYSIS:

PRICE: $161.89 (+3.38% today)

TARGET: $185.00 (+14.3%)

RATING: BUY

CATALYST: AWS_GROWTH_ACCELERATION

Investment Thesis: Amazon Web Services continues to dominate cloud computing with 32% market share. E-commerce recovery and advertising business growth provide multiple expansion opportunities. Recent cost optimization initiatives improving margins significantly.

4. Johnson & Johnson (JNJ) – $158.24

JNJ_ANALYSIS:

PRICE: $158.24 (+0.21% today)

TARGET: $175.00 (+10.6%)

RATING: BUY

CATALYST: PHARMACEUTICAL_PIPELINE

Investment Thesis: J&J’s robust pharmaceutical pipeline and medical device innovation drive sustainable growth. Dividend aristocrat status with 61 consecutive years of increases provides income stability. Recent spin-off creating focused healthcare pure-play.

⚡ High-Growth Momentum Plays

5. Tesla Inc. (TSLA) – $248.44

TSLA_ANALYSIS:

PRICE: $248.44 (+2.15% today)

TARGET: $285.00 (+14.7%)

RATING: BUY

CATALYST: FULL_SELF_DRIVING

Investment Thesis: Tesla’s Full Self-Driving technology approaching regulatory approval represents massive value creation opportunity. Energy storage business growing 40% annually. Cybertruck production ramp addressing commercial vehicle market.

6. Microsoft Corporation (MSFT) – $428.91

MSFT_ANALYSIS:

PRICE: $428.91 (+0.85% today)

TARGET: $475.00 (+10.7%)

RATING: BUY

CATALYST: AZURE_AI_INTEGRATION

Investment Thesis: Microsoft’s Azure cloud platform benefits from AI integration and enterprise digital transformation. Office 365 and Teams ecosystem provides recurring revenue stability. Strategic AI investments positioning for long-term dominance.

💰 Value and Dividend Opportunities

7. Berkshire Hathaway Inc. (BRK.B) – $445.67

BRK.B_ANALYSIS:

PRICE: $445.67 (+0.32% today)

TARGET: $485.00 (+8.8%)

RATING: BUY

CATALYST: CASH_DEPLOYMENT

Investment Thesis: Berkshire’s $189 billion cash position provides significant acquisition firepower. Diversified operating businesses generating strong cash flows. Warren Buffett’s value investing approach creating long-term wealth.

8. Procter & Gamble Co. (PG) – $167.45

PG_ANALYSIS:

PRICE: $167.45 (+0.18% today)

TARGET: $180.00 (+7.5%)

RATING: HOLD

CATALYST: BRAND_STRENGTH

Investment Thesis: P&G’s portfolio of trusted consumer brands provides defensive characteristics and steady dividend growth. 68-year dividend increase streak demonstrates management commitment to shareholders. Premium valuation limits upside potential.

🔬 Emerging Opportunities

9. Advanced Micro Devices (AMD) – $158.24

AMD_ANALYSIS:

PRICE: $158.24 (+1.95% today)

TARGET: $185.00 (+16.9%)

RATING: BUY

CATALYST: DATA_CENTER_GROWTH

Investment Thesis: AMD’s EPYC processors gaining market share in data centers. AI chip development competing with NVIDIA in high-growth segments. Xilinx acquisition providing FPGA capabilities for specialized computing.

10. Zoom Video Communications (ZM) – $123.78

ZM_ANALYSIS:

PRICE: $123.78 (+2.45% today)

TARGET: $145.00 (+17.1%)

RATING: BUY

CATALYST: AI_INTEGRATION

Investment Thesis: Zoom’s AI-powered features enhancing productivity and user experience. Enterprise adoption of Zoom Phone and Rooms expanding total addressable market. Hybrid work trends supporting long-term demand.

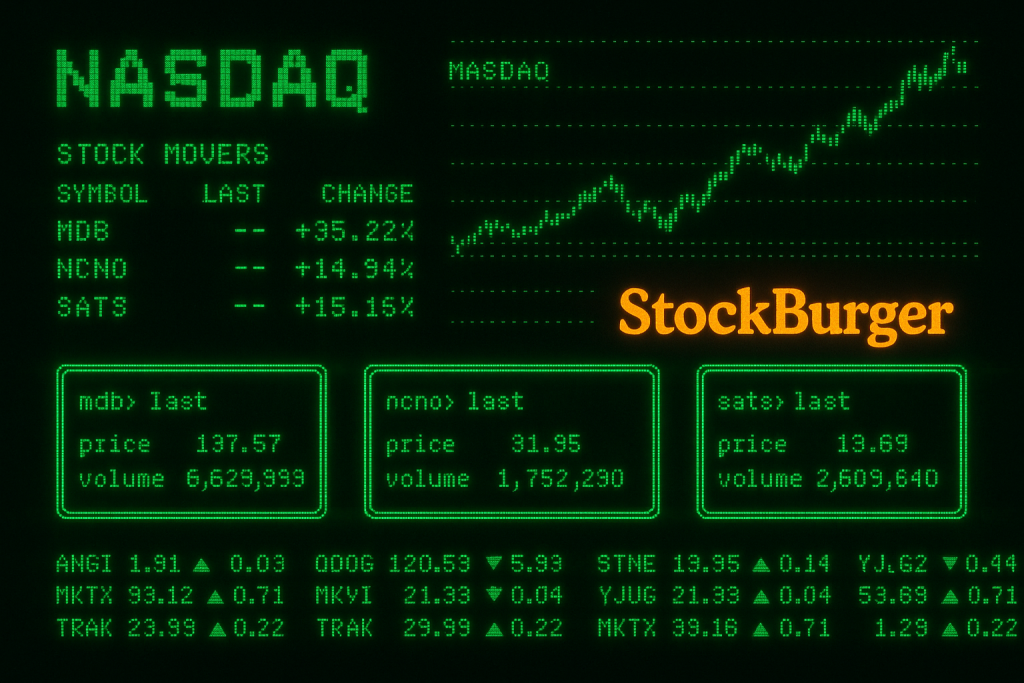

📈 Technical Analysis Summary

TECHNICAL_INDICATORS:

MARKET_TREND: BULLISH

MOMENTUM: POSITIVE

VOLATILITY: LOW (VIX: 14.8)

SECTOR_ROTATION: TECH_LEADING

Key Technical Levels

- S&P 500: Support at 4,800, resistance at 4,900

- NASDAQ: Support at 15,500, resistance at 16,200

- Technology Sector: Outperforming with strong momentum

- Energy Sector: Consolidating after recent volatility

🎯 Trading Strategy

Short-Term (1-3 Days)

- Momentum Plays: NVDA, TSLA, AMD for continued tech strength

- Earnings Reactions: Monitor post-earnings moves in recent reporters

- Sector Rotation: Technology leading, energy lagging

Medium-Term (1-4 Weeks)

- Growth Focus: AMZN, MSFT, ZM for sustained outperformance

- Value Opportunities: AAPL dip, BRK.B cash deployment

- Defensive Positions: JNJ, PG for portfolio stability

Long-Term (3-12 Months)

- AI Revolution: NVDA, MSFT leading artificial intelligence adoption

- Digital Transformation: AMZN, ZM benefiting from enterprise shifts

- Quality Compounders: JNJ, BRK.B for wealth building

⚠️ Risk Management

RISK_ASSESSMENT:

MARKET_RISK: MODERATE

SECTOR_CONCENTRATION: HIGH_TECH

VOLATILITY: LOW_CURRENT

DIVERSIFICATION: RECOMMENDED

Key Risk Factors

- Market Concentration: Heavy technology weighting increases sector risk

- Interest Rate Sensitivity: Growth stocks vulnerable to rate changes

- Geopolitical Tensions: Trade relationships affecting multinational companies

- Economic Indicators: Inflation and employment data impacting sentiment

📊 Portfolio Allocation Recommendation

Suggested Allocation for Balanced Growth Portfolio:

- 40% Technology: NVDA (10%), MSFT (10%), AAPL (10%), AMD (5%), TSLA (5%)

- 20% Consumer/Retail: AMZN (15%), ZM (5%)

- 20% Healthcare/Defensive: JNJ (15%), PG (5%)

- 20% Value/Diversified: BRK.B (20%)

Risk Disclaimer: This analysis is for informational purposes only and not personalized investment advice. Stock investments carry risks including market volatility, company-specific challenges, and economic factors. Past performance does not guarantee future results. Always conduct your own research and consider your risk tolerance before investing.