Whales with a lot of money to spend have taken a noticeably bullish stance on Intuitive Surgical.

Looking at options history for Intuitive Surgical ISRG we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 9% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $77,900 and 9, calls, for a total amount of $448,950.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $560.0 for Intuitive Surgical, spanning the last three months.

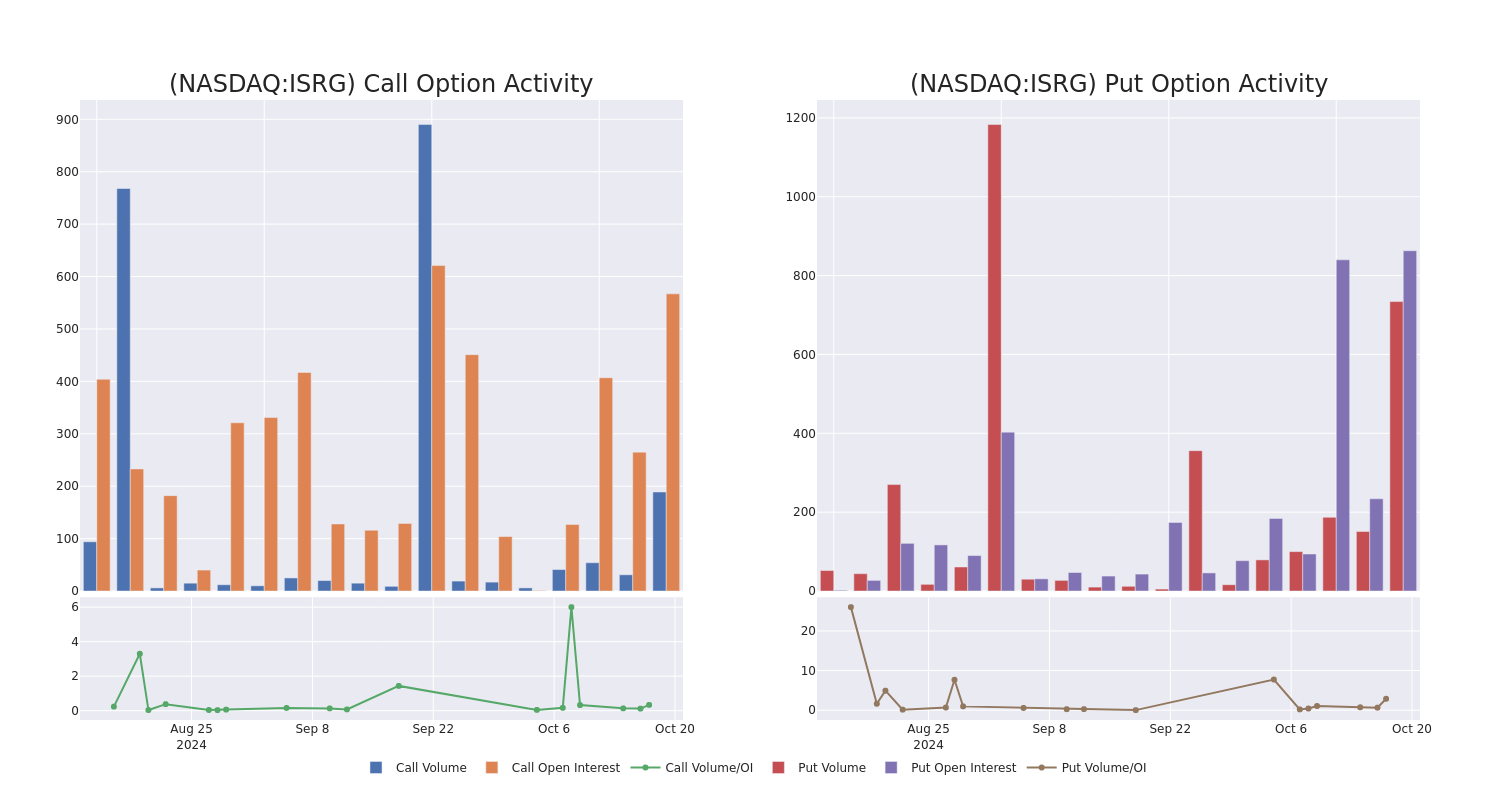

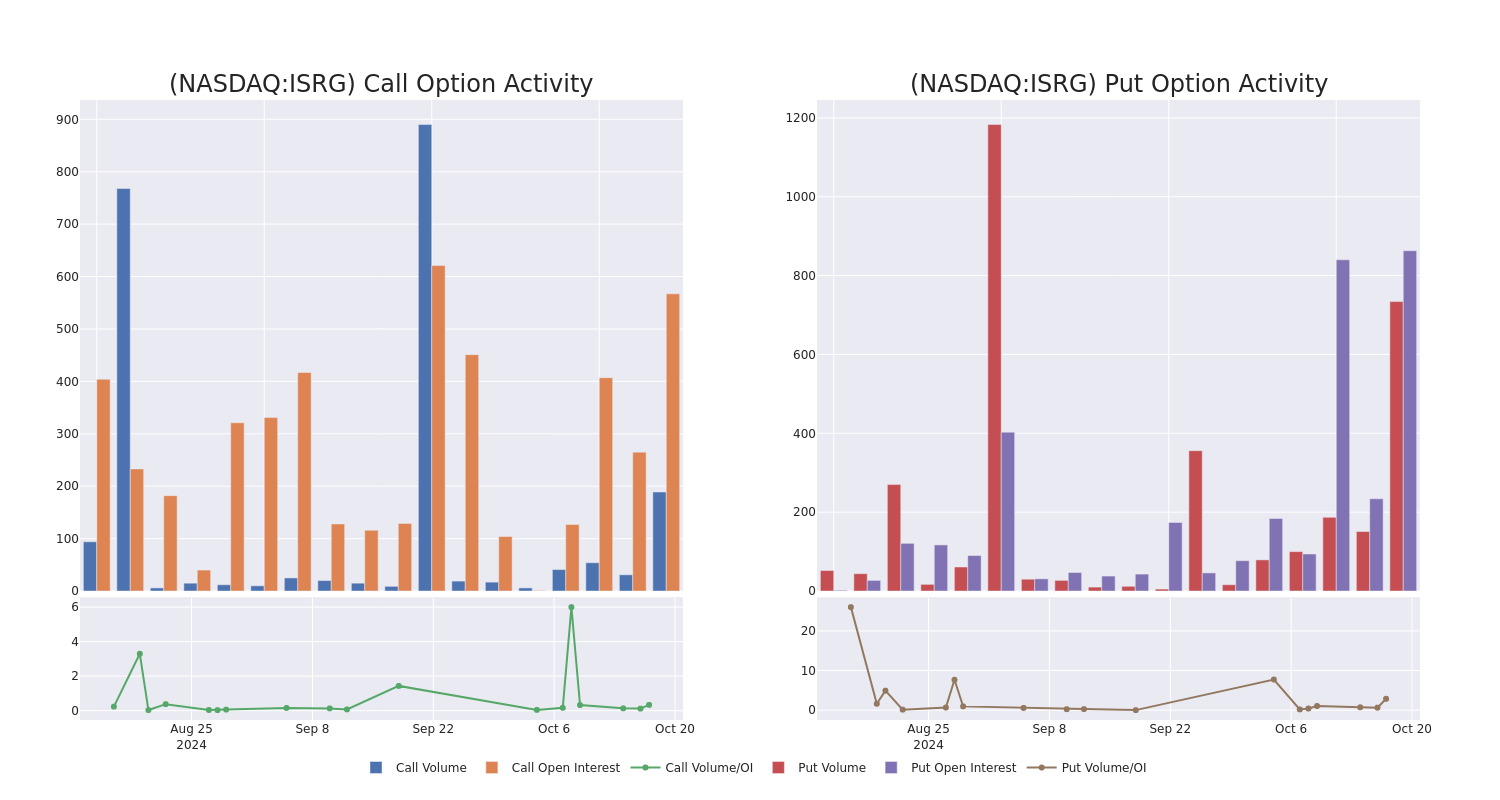

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Intuitive Surgical options trades today is 157.75 with a total volume of 182.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuitive Surgical's big money trades within a strike price range of $240.0 to $560.0 over the last 30 days.

Intuitive Surgical Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | NEUTRAL | 01/17/25 | $21.3 | $19.6 | $19.7 | $550.00 | $78.8K | 575 | 54 |

| ISRG | CALL | SWEEP | BULLISH | 06/20/25 | $65.0 | $60.7 | $65.0 | $520.00 | $65.0K | 173 | 10 |

| ISRG | CALL | TRADE | NEUTRAL | 06/20/25 | $64.9 | $61.4 | $63.0 | $520.00 | $63.0K | 173 | 20 |

| ISRG | CALL | TRADE | NEUTRAL | 01/17/25 | $305.0 | $300.7 | $302.7 | $240.00 | $60.5K | 52 | 2 |

| ISRG | CALL | TRADE | BULLISH | 03/21/25 | $28.8 | $27.6 | $28.8 | $560.00 | $57.6K | 140 | 20 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Following our analysis of the options activities associated with Intuitive Surgical, we pivot to a closer look at the company's own performance.

Present Market Standing of Intuitive Surgical

- With a trading volume of 478,667, the price of ISRG is up by 0.66%, reaching $540.1.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 56 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Intuitive Surgical, Benzinga Pro gives you real-time options trades alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.