Financial giants have made a conspicuous bearish move on NuScale Power. Our analysis of options history for NuScale Power SMR revealed 15 unusual trades.

Delving into the details, we found 13% of traders were bullish, while 80% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $1,401,726, and 3 were calls, valued at $194,250.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $12.0 to $32.0 for NuScale Power over the last 3 months.

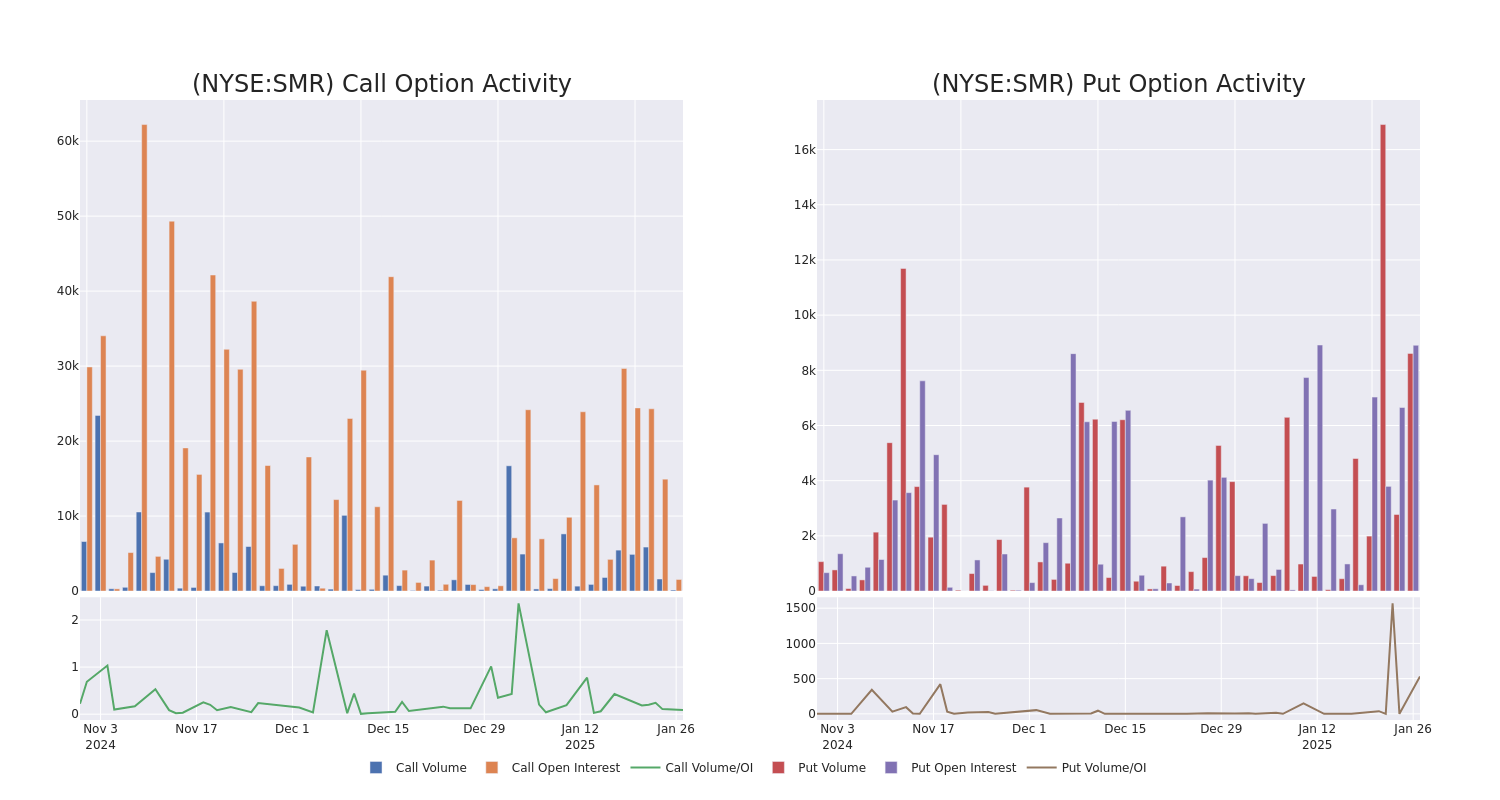

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for NuScale Power's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across NuScale Power's significant trades, within a strike price range of $12.0 to $32.0, over the past month.

NuScale Power 30-Day Option Volume & Interest Snapshot

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMR | PUT | SWEEP | BEARISH | 02/21/25 | $2.73 | $2.46 | $2.55 | $22.00 | $454.1K | 8.7K | 3.3K |

| SMR | PUT | SWEEP | BEARISH | 08/15/25 | $14.25 | $14.2 | $14.25 | $32.00 | $179.8K | 9 | 650 |

| SMR | PUT | TRADE | BULLISH | 08/15/25 | $14.65 | $14.3 | $14.36 | $32.00 | $143.6K | 9 | 950 |

| SMR | PUT | TRADE | BEARISH | 08/15/25 | $14.25 | $14.05 | $14.23 | $32.00 | $142.3K | 9 | 330 |

| SMR | PUT | TRADE | BULLISH | 08/15/25 | $14.25 | $14.0 | $14.1 | $32.00 | $141.0K | 9 | 0 |

About NuScale Power

NuScale Power Corp is engaged in the development of a new modular light water reactor nuclear power plant to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications.

Having examined the options trading patterns of NuScale Power, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of NuScale Power

- With a trading volume of 8,231,450, the price of SMR is down by -17.05%, reaching $23.2.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 45 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NuScale Power options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.