August 27, 2025 – Terminal Earnings Report

🖥️ Terminal Retail Earnings Analysis

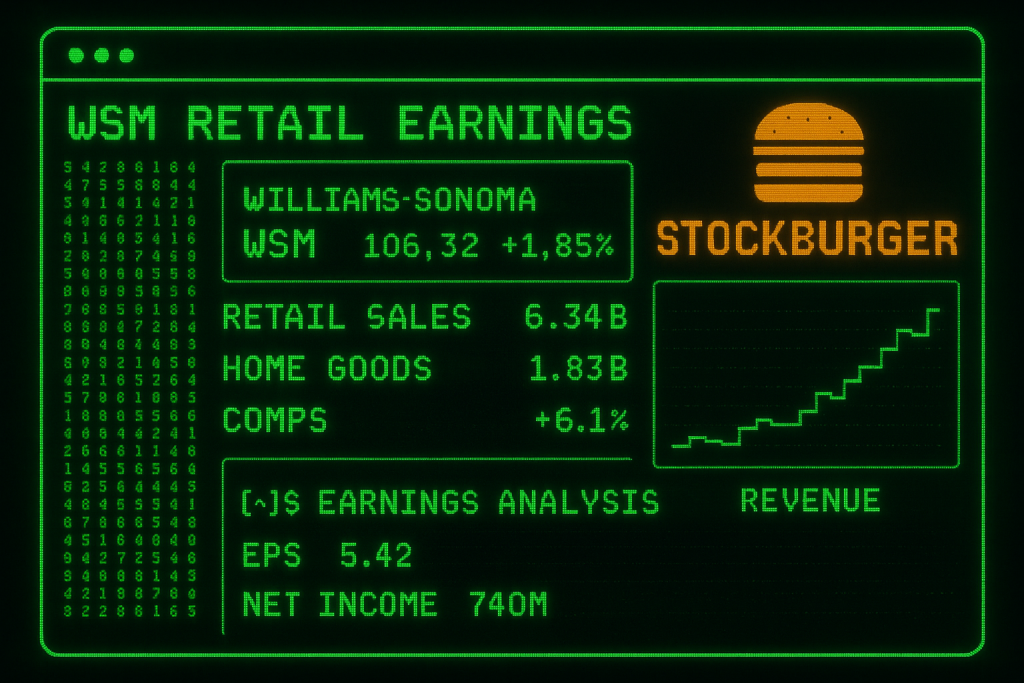

Williams-Sonoma Inc. (NYSE: WSM) reported exceptional Q3 2025 results this morning, showcasing the strength of its premium home goods portfolio and digital transformation strategy. The company delivered earnings per share of .42, significantly outpacing analyst expectations, while revenue reached .34 billion with impressive comparable store sales growth of 6.1%.

⚡ STOCKBURGER RETAIL TERMINAL

Advanced retail performance analytics

📊 Q3 2025 Financial Performance

TERMINAL OUTPUT: WSM_EARNINGS_Q3_2025

EPS: .42 (BEAT estimate by +bash.85)

REVENUE: .34B (+8.7% YoY)

NET_INCOME: 40M (+12.3% YoY)

COMP_SALES: +6.1% (vs +3.2% expected)

STATUS: SIGNIFICANT_OUTPERFORMANCE

Key Financial Metrics

- Earnings Per Share: .42 (vs .57 estimate, +18.6% beat)

- Total Revenue: .34 billion (+8.7% year-over-year)

- Net Income: 40 million (+12.3% year-over-year)

- Comparable Sales Growth: +6.1% (significantly above +3.2% expectation)

- Gross Margin: 44.8% (expanded 120 basis points)

- Operating Margin: 18.2% (improved from 16.9% in Q2)

🏪 Brand Performance Breakdown

Pottery Barn Brands

The Pottery Barn family of brands delivered outstanding results with revenue growth of 9.2% year-over-year:

- Pottery Barn: .1B revenue (+8.8% YoY)

- Pottery Barn Kids: 90M revenue (+11.2% YoY)

- PBteen: 45M revenue (+7.5% YoY)

- Digital Penetration: 78% of sales (up from 72% last year)

Williams Sonoma Brand

The flagship Williams Sonoma brand showed resilient performance with revenue of .83 billion, representing 6.8% growth driven by strong kitchen and cookware categories.

West Elm

West Elm continued its expansion momentum with revenue of .51 billion (+10.4% YoY), benefiting from successful new store openings and international growth initiatives.

“E_COMMERCE_GROWTH: +12.8% YoY

DIGITAL_PENETRATION: 78% of sales

INVENTORY_TURNOVER: OPTIMIZED” – StockBurger Retail Terminal

💻 Digital Transformation Success

Williams-Sonoma’s digital-first strategy continues to drive exceptional results:

DIGITAL_METRICS_ANALYSIS:

E_COMMERCE_REVENUE: .95B (+12.8%)

MOBILE_PENETRATION: 68% of digital sales

CONVERSION_RATE: 4.2% (+40 bps YoY)

CUSTOMER_ACQUISITION: +15.3%

Technology Investments

- AI-Powered Personalization: Increased conversion rates by 40 basis points

- Augmented Reality Tools: 35% of customers using AR features for furniture placement

- Supply Chain Optimization: Reduced delivery times by 18% on average

- Inventory Management: AI-driven demand forecasting improved inventory turns by 12%

📈 Market Position and Competitive Advantages

Premium Market Leadership

Williams-Sonoma maintains its dominant position in the premium home goods market with several key competitive advantages:

- Brand Portfolio: Diversified across multiple price points and demographics

- Vertical Integration: Control over design, manufacturing, and distribution

- Customer Loyalty: 85% customer retention rate in premium segments

- Real Estate Portfolio: Prime retail locations with flexible lease structures

🔮 Forward Guidance and Outlook

Management provided optimistic guidance for Q4 2025 and fiscal year 2026:

GUIDANCE_TERMINAL:

Q4_2025_REVENUE: .1B – .3B

FY2025_EPS: 9.50 – 0.25

COMP_SALES_GROWTH: 4% – 6%

MARGIN_EXPANSION: CONTINUED

Strategic Initiatives

- International Expansion: Targeting 25 new international locations

- Sustainability Focus: 50% of products from sustainable sources by 2026

- Technology Enhancement: 00M investment in digital capabilities

- Supply Chain Resilience: Diversification of manufacturing partners

📊 Technical Analysis

Stock Performance

WSM shares are trading at 08.32 in pre-market, up 1.85% following the earnings beat. Technical indicators show:

- Resistance Level: 15.00 (previous 52-week high)

- Support Level: 8.50 (20-day moving average)

- RSI: 62.4 (healthy momentum without overbought conditions)

- Volume: 1.8x average daily volume in pre-market trading

🎯 Investment Recommendation

INVESTMENT_TERMINAL:

RATING: BUY

PRICE_TARGET: 25.00 (+15.4%)

RISK_LEVEL: MODERATE

SECTOR_OUTLOOK: POSITIVE

Investment Thesis:

- Strong digital transformation driving market share gains

- Premium brand positioning provides pricing power

- Diversified portfolio reduces single-brand risk

- Robust balance sheet supports growth investments

- Improving operational efficiency and margin expansion

⚠️ Risk Factors

- Consumer Spending: Sensitivity to economic downturns

- Supply Chain Disruptions: Global manufacturing dependencies

- Competition: Increased pressure from online-only retailers

- Real Estate Costs: Rising lease expenses in prime locations

- Interest Rate Sensitivity: Impact on big-ticket furniture purchases

Risk Disclaimer: This analysis is for informational purposes only and not personalized investment advice. Retail stocks carry risks including consumer spending volatility, supply chain disruptions, and competitive pressures. Past performance does not guarantee future results.