Financial giants have made a conspicuous bullish move on XPeng. Our analysis of options history for XPeng XPEV revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $101,800, and 5 were calls, valued at $879,208.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $6.0 to $10.0 for XPeng during the past quarter.

Insights into Volume & Open Interest

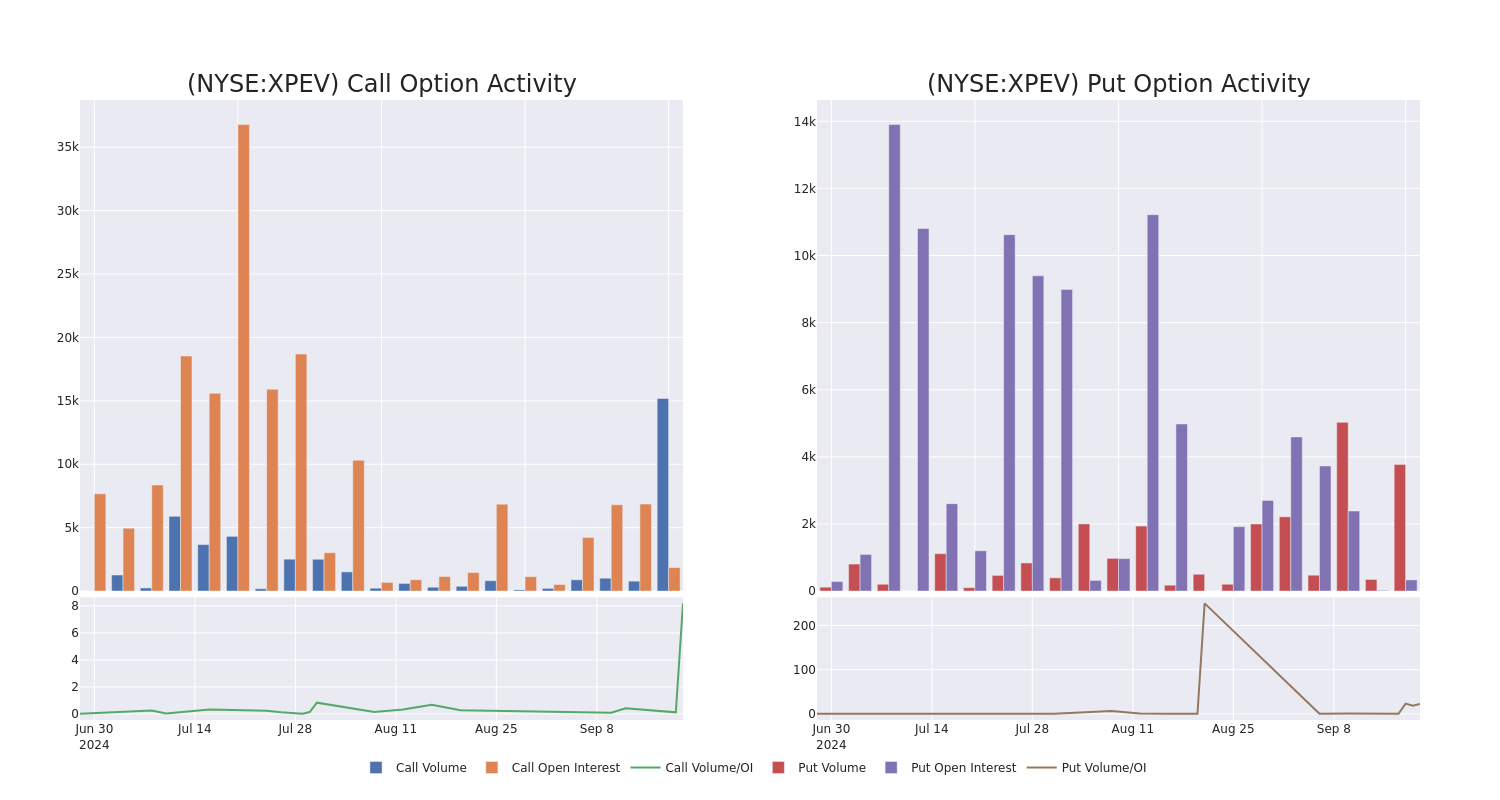

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for XPeng's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of XPeng's whale activity within a strike price range from $6.0 to $10.0 in the last 30 days.

XPeng Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XPEV | CALL | SWEEP | BULLISH | 04/17/25 | $1.82 | $1.75 | $1.82 | $10.00 | $387.1K | 465 | 2.1K |

| XPEV | CALL | SWEEP | BULLISH | 04/17/25 | $1.88 | $1.85 | $1.88 | $10.00 | $363.5K | 465 | 4.0K |

| XPEV | CALL | SWEEP | BEARISH | 01/17/25 | $3.85 | $3.8 | $3.8 | $6.00 | $53.1K | 1.3K | 143 |

| XPEV | PUT | SWEEP | BULLISH | 10/04/24 | $0.15 | $0.13 | $0.13 | $8.50 | $39.0K | 277 | 3.1K |

| XPEV | CALL | TRADE | BEARISH | 04/17/25 | $1.91 | $1.89 | $1.89 | $10.00 | $37.8K | 465 | 4.5K |

About XPeng

Founded in 2015, XPeng is a leading Chinese smart electric vehicle company that designs, develops, manufactures, and markets EVs in China. Its products primarily target the growing base of technology-savvy middle-class consumers in the midrange to high-end segment in China's passenger vehicle market. The company sold over 141,000 EVs in 2023, accounting for about 2% of China's passenger new energy vehicle market. It is also a leader in autonomous driving technology.

Following our analysis of the options activities associated with XPeng, we pivot to a closer look at the company's own performance.

Where Is XPeng Standing Right Now?

- Currently trading with a volume of 12,013,899, the XPEV's price is up by 2.13%, now at $9.59.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 54 days.

Expert Opinions on XPeng

1 market experts have recently issued ratings for this stock, with a consensus target price of $11.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Showing optimism, an analyst from JP Morgan upgrades its rating to Overweight with a revised price target of $11.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for XPeng with Benzinga Pro for real-time alerts.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.